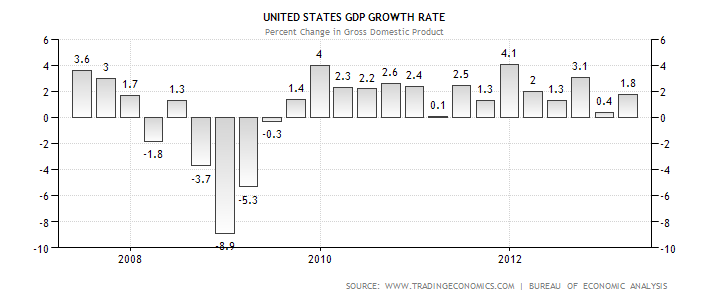

With yesterday’s miss in US retail sales, notoriously optimistic investment analysts are reluctantly having to downsize their estimates for US Q2 GDP. The official first guesstimate will not be released until July 30, but as of today, the consensus just moved to expecting a .60 annualized growth rate for Q2. This compares with the 3% estimate the same group forecast for this quarter 2 years ago, and the 2.1% estimate they offered just last December. And although QEternity jawboning from the Fed helped to pump up stock prices (rather than investment value) by trillions over the past 9 months, the reality is that a .6% Q2 read would bring US economic growth over the last 3 quarters, to a barely beating .86% annualized rate. Surpise, surprise. Meanwhile, unable to see a downturn ’til it’s driving over their feet, the consensus estimate on S&P earnings per share has now moved from a 6.1% growth expectation at the start of March, to 2.6% today (and falling…).

But never to worry, the consensus is still calling for a moonshot recovery in growth in the second half…stay tuned.