Europe is again coming apart at the seams as the extend and pretend liquidity stitches of the past couple of years have once more worn through revealing a still torn, and now even more indebted, society. See this excellent update: The wheels are coming off the whole of southern Europe.

Alastair Newton, senior political analyst at Nomura, explains that October will be a crucial month for Europe due to sensitive reviews in Greece, France and Italy. Here is a direct video link.

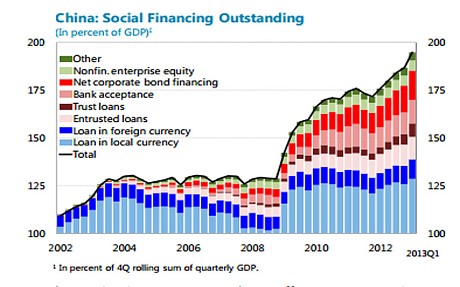

China meanwhile, who was the biggest spender in efforts to stimulate the world out of the great recession of 2008, is now drowning in a fresh and intensified credit crisis. According to the IMF’s estimates, loans have jumped from $9 trillion to $23 trillion since 2008, a faster pace of debt build-up than in any major episode of the past century. See: China defies IMF on mounting credit risk and need for urgent reform.

At the same time, see: The End of QE looms on signals from UK and US. Central Banks and governments had hoped that if they spent, bad debts could be recovered, mistakes covered up, and a robust recovery would grow the world out of insolvency. 5 years later, the globe finds itself back in recession with more debt than ever. Time to knock off zeros and let reckless actors take their losses. Time to start fresh and direct available precious cash flow back into productive investment in lasting infrastructure and people. Only then can a true recovery begin.

At the same time, see: The End of QE looms on signals from UK and US. Central Banks and governments had hoped that if they spent, bad debts could be recovered, mistakes covered up, and a robust recovery would grow the world out of insolvency. 5 years later, the globe finds itself back in recession with more debt than ever. Time to knock off zeros and let reckless actors take their losses. Time to start fresh and direct available precious cash flow back into productive investment in lasting infrastructure and people. Only then can a true recovery begin.