Follow

____________________________

Cory’s Chart Corner

Load MoreHeadline chasing algos need to do deeper dives...

h/t @hussmanjp John P. Hussman, Ph.D. @hussmanjp

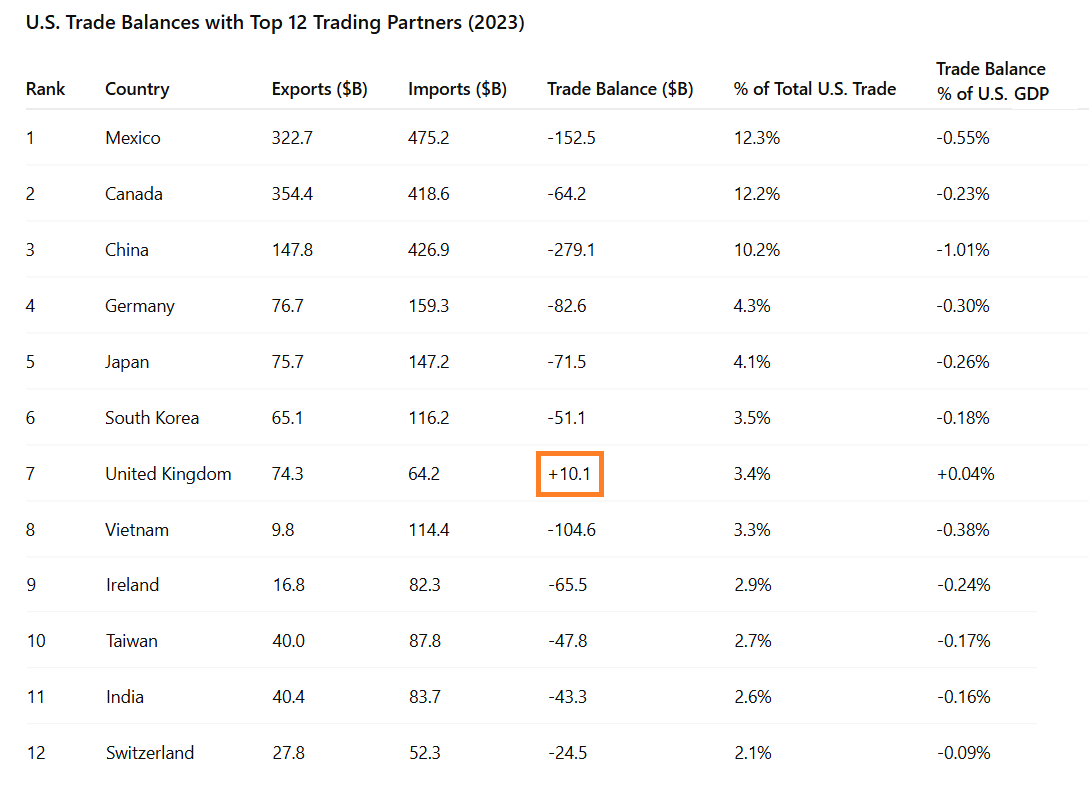

John P. Hussman, Ph.D. @hussmanjpy'all realize the UK is only about 3% of U.S. trade, the U.S. already runs a surplus there, and the 10% U.S. tariffs will stay, right?

keep in mind that studies indicate U.S. consumers shoulder the majority of tariff incidence, with minor incidence to foreign countries____________________________

Danielle’s Book

Media Reviews

“An explosive critique about the investment industry: provocative and well worth reading.”

Financial Post“Juggling Dynamite, #1 pick for best new books about money and markets.”

Money Sense“Park manages to not only explain finances well for the average person, she also manages to entertain and educate while cutting through the clutter of information she knows every investor faces.”

Toronto SunSubscribe

This Month

Archives

Log In

Monthly Archives: July 2013

Danielle’s weekly market update

Danielle was a guest today on Talk Digital Network with Phil Mackesy talking about recent developments in the world economy and markets. You can listen to an audio clip of the segment here.

Institutional managers 55% cash awaiting better prices ahead

While most retail financial advisors today are counselling clients to remain fully allocated to risk markets near 6 year highs (they always do, at least until after big losses hit and then they will suggest some switching around) institutional managers, … Continue reading

Sberbank: “commodity supercycle is over”

Kingsmill Bond, chief strategist at Sberbank, tells CNBC that the commodity super-cycle has peaked and we are going to trend down for the foreseeable future. This presents now challenging math for commodity-centric economies (Brazil, Russia, Australia, Canada) who were riding … Continue reading