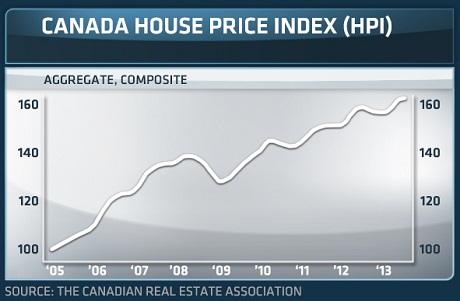

After last week’s “surprising” capitulation by the Bank of Canada where it lowered Canada’s growth outlook for the next 2 years, the Canadian dollar is back flirting with the lows of the year and a new Goldman Sachs report highlights downside risks in the highly valued Canadian housing market. See:Goldman warns on large correction in Canadian housing

“Canada is careering towards a sharp fall in house prices with some areas of the country’s market already showing signs that overbuilding and ultralow interest rates are taking their toll on the property market, Goldman Sachs reports.

Adding its voice to a growing chorus of concern, a report from Hui Shan, an economist at Goldman, late last week warned: “what goes up can keep going up, but then tends to come down.”

What’s that? prices that go up too far tend to come down? Not the stock market though…it will never come down again, right?