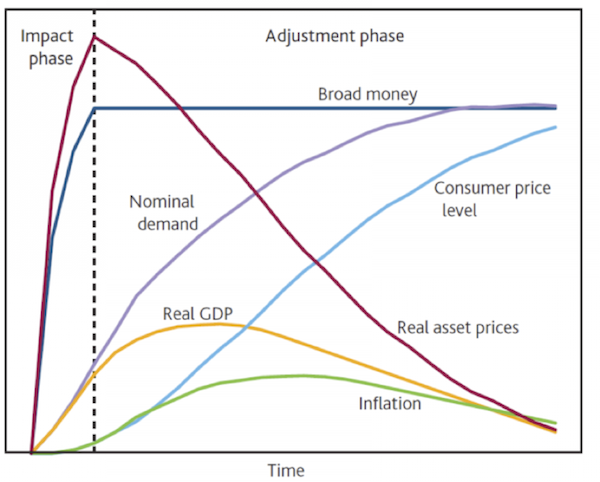

For the past 3 years, I have often wondered aloud whether Central Bankers could actually be as obtuse as they seem. Or whether they truly believe that forcing asset prices higher could be a sustainable long-term support for the economy. This weekend we got the answer courtesy of John Mauldin’s weekly in the below chart published by the Bank Of England in Q3 2011 outlining the central banks anticipated impacts on key economic indicators through their much celebrated Quantitative Easing experiments in global markets. So far they have accomplished the huge spike up in prices drawn in the “impact phase” the trouble is that all of the other indicators have already decoupled and turned lower faster than they had predicted. And now we have the plotted trajectory of real asset prices to look forward to. Now we know then that the plan was always aimed at buying some short-term time for the banks to re-liquify, followed by inevitable financial devastation to investors, retirees, pension plans and others as necessary collateral damage.

Follow

____________________________

____________________________

Danielle’s Book

Media Reviews

“An explosive critique about the investment industry: provocative and well worth reading.”

Financial Post“Juggling Dynamite, #1 pick for best new books about money and markets.”

Money Sense“Park manages to not only explain finances well for the average person, she also manages to entertain and educate while cutting through the clutter of information she knows every investor faces.”

Toronto SunSubscribe

This Month

Archives

Log In