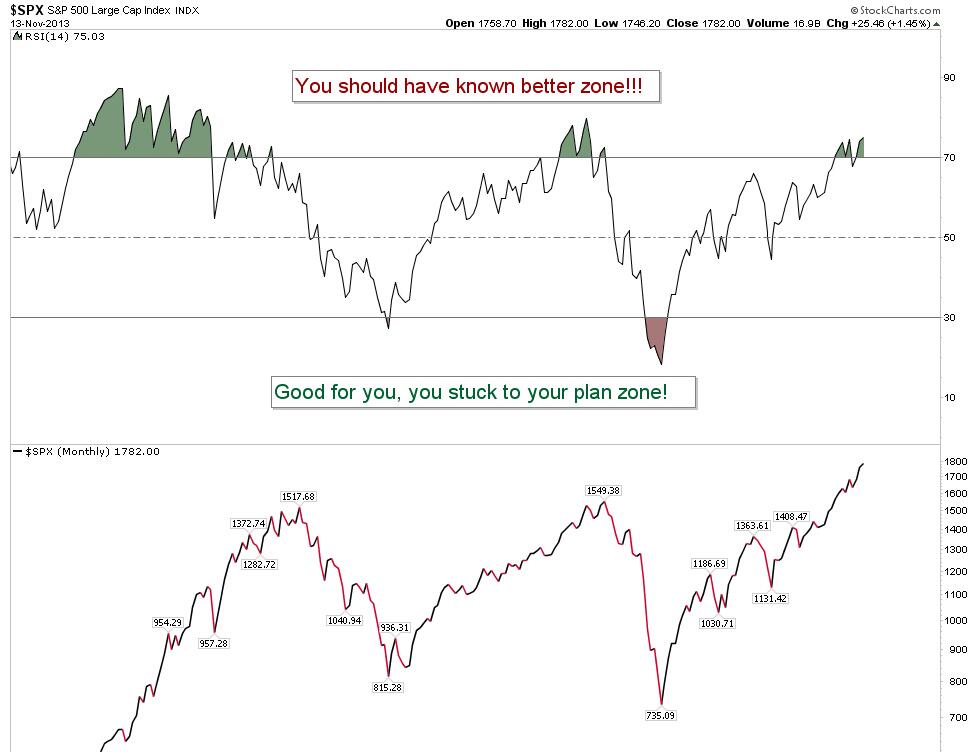

The investment sales business has been moving through a period of consolidation over the past 13 years–especially over the past 5 since the great recession. Notwithstanding the last year of QE mania that finally goosed US stocks slightly above their 2000 and 2007 cycle peaks once more, stocks have been a losing bet for long-term investors, pensions and long always investment funds since this secular bear period began in 2000. This chart courtesy of my partner Cory Venable captures the nominal experience well. (Of course in real returns, the reality is even worse with the S&P earning negative returns since 2000).

This has made for many unhappy customers at traditional investment sales and management shops. Clients have been moving from one adviser to another looking for better returns: higher yields, free lunches and “different” stock markets (those that only go up!) in which to be invested.

Hand in hand with all of this disquiet and volatility has been a higher than normal migration of investment brokers from one sales firm to another. If one pays attention they will note that many “advisors” have switched firms a couple of times over the past 13 years. (The pattern is actually about once each 5 year market cycle anyway, but the increased volatility and negative returns of secular bear periods accentuate the pattern.)

Each switch the broker calls up existing clients (they try to do this after stocks have been in the rally part of the cycle and before the next bear market hits so clients are more amenable to sticking with them) and convince clients that the new firm is far more client focused: “much better products and far more accurate research and insights”.

What the clients are not told of course, is that their “advisers” are offered huge financial incentives to bring clients over to the new firm. Depending on the size of client assets that a broker is able to move, upfront signing bonuses paid from the acquiring firm can run from several hundred thousand to more than a million dollars. The more they are paid up front, the more the incentive to the broker to convince their trusting clients that the move is in the “clients’ best interests”. After the move of course, there is also increased pressure on the brokers to “produce” commissions and fees from their client assets in order to pay their new employer back for the signing bonus they received up front.

All of these inside deals are just another common way in which sales firms and advisers make secret profits at the expense of trusting clients. So the next time, your friendly broker calls to tell you how a move with them to a new firm is all about better client service. Ask what bonus they are being paid in the move. Since the fees they receive will be then be recouped from your life savings, you really do have a right to know.