My daughter was studying for a history test on the 1920’s this weekend, last night we watched this documentary together. I had not seen this one before. Can’t help but recognize familiar themes with recent trends in financial markets. One notable difference is that in 1929 the FOMC was warning that margin abuse and an over-valued stock market were dangerous for the real economy. Today the Bernanke/Yellen Fed point proudly to the overbought stock market as proof of all their good work. Here is a direct video link.

One of the most infamous and relentless modern day Perma-bulls, Jeremy Siegel is featured on CNBC this morning pronouncing US stocks as fairly priced with US markets at all time nominal highs–now up 32% over the past 12 months–even as corporate revenue and earnings continue to plunge. Of course after writing his signature book “Stocks for the Long Run” at the peak of the secular bull in 1999, Siegel has been trying to justify and defend his devastating record ever since. In his book preface, he thanks the sell side brokerage firms for all their financial support and patronage in furthering his writing and speaking career. And the sell side loves him to be sure.

Here was Siegel in 2008 offering his usual jubilant take see2008 economic and market forecast:

“I believe the stock market will do better in 2008 than it did in 2007, when it chalked up a 5.5% return, the fifth year in a row that the market went up. Year-ahead forecasts for the stock market are notoriously difficult, but I believe that a 10% to 12% gain is possible, on the heels of a recovering financial sector. Financial stocks plummeted almost 20% last year, and this was the reason why the market had a mediocre year. Outside of financials, the S&P 500 Index had double-digit returns. A revival of financial stocks would spur good market gains this year.”

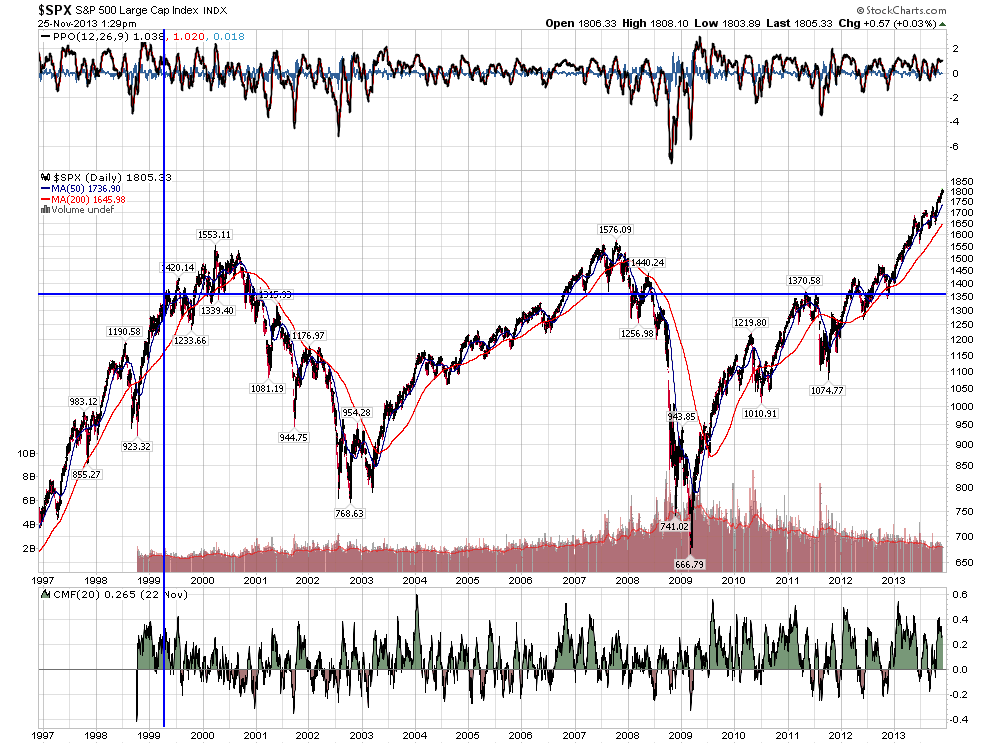

A little math worth appreciating here: since the last cyclical bear ended in March 2009, US stocks have rallied 170% –59% of that just over the past 24 months on Q’ever promises from the US Fed. Before the QE gift of the past 12 months, which has emboldened so many Perma-bulls to think they are genius once more, the S&P had gained just an average of 1.67% year between 2000 and 2012. Even including the past year’s magical ramp, the S&P has now averaged just 3.2% a year (before any fees) since the secular began in 2000 on the launch of Siegel’s reckless book. (The Canadian stock market has gained even less (1.22%/year),being today still some 12% lower than its June 2008 peak). So stocks have averaged less than cash and bonds for 14 years with heart-stopping volatility that has included two 50% drops.

Most important of all and what no bull wishes to acknowledge: it will now only require an average little run of the mill bear market decline of -25% from here to wipe out all of the S&P’s price gains since 1999. Genius? Welcome to our secular bear.