Bubble television is rolling out all the usual bull artifacts to justify why stocks keep going up: Abbey Joseph Cohen (Ms. tech stocks for the long-run of 1999 and commodity stocks for the long run of 2008) and Warren Buffet (now Mr. S&P 500 closet indexer, see: Buffett’s return-free-risk round trip) et al. But for those that prefer rational gauges and a reasonable shot at protecting and growing their savings over time, there are glaring holes “in the stocks are attractively priced” story today.

The historically reliable Shiller PE (price/10 year average real earnings) is today at 25, giving US stocks in 2013 the distinction of being the most notoriously priced since the Tech bubble peak of 2000 (where it was 44) and the leverage bubble peak of 1929(where it was 32) as compared with Shiller PE’s between 5 and 8 in secular bottom lows in 1921, 1932, 1942 and 1982. See this chart for a big picture view.

Analysts (at least any that are sentient) know perfectly well that the Shiller PE at 25 suggests that at present values stocks are priced to earn negative returns over the next 7-10 years. But since they need to sell stock investing to the public at every price they reach for different ways to parcel valuation data. One quick fix tool is to divide the current S&P index price by its “trailing 12 month earnings” (TTM). On this measure the current S&P price to TTM clocks in at 18.6 compared with a historic average since 1870 of 15 and a reading of 6ish at secular bear lows on this metric in 1920, 1950 and 1980.

Not to be put off, bullish analysts next stoop for that infamously delusional indicator: the Price/forward 12 month estimated earnings ratio. This one is a particular laughing stock for a few reasons. First of all sell side analysts are well documented to be horribly over-optimistic at forecasting earnings. They literally place a ruler under last quarter’s earnings trend and draw a straight line up. In this way they have over-estimated earnings growth every single quarter except at recession bottoms where they finally flip their ruler down and turn bearish just as momentum finally turns up. As a recent example, analyst consensus was expecting S&P earnings growth of 10% in the 3rd quarter of 2013, and the actual growth came in at just 4%. In any event, their current consensus estimate for 12 month forward S&P earnings is an all time high $119.30 which at 1803 for the S&P works out to a P/E forward ratio of 15.11 which they argue is only average not expensive.

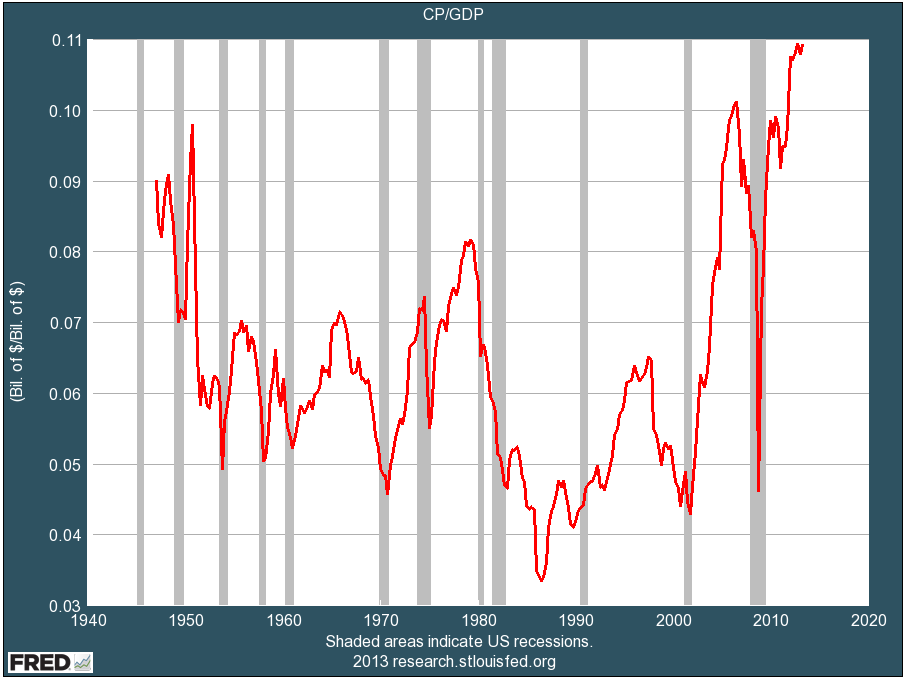

But as John Hussman explains so well this week in An Open Letter to the FOMC, using forward-extrapolating-rules-of-thumb for earnings estimates is particularly dangerous today because of a spate of unusual phenomenon the past 4 years (wage reduction and labor suppression out of the great recession, productivity increases and stock buybacks rather than fixed investment) which have led to the highest ever recorded corporate profits as a percentage of GDP ever, as graphed in this chart:

The historical mean for corporate profits after tax is 6% of GDP. Today this ratio sits 70% above average at more than 10%. So those forecasting higher corporate earnings from here are assuming that this time is different and corporations can only make more and more while governments and households earn and have less and less. They assert that this time trees profits will grow to the sky.

Based on historical mean reversion patterns though, present outsized profits would need to contract by more than 15% a year over the next 4 years to restore their long-term equilibrium with economic growth. We will then see just how “attractive” today’s record high equity prices will measure by then.