While US equity returns have been undeniably jubilant over the past 12 months, the reality is that the calendar year end is not a definitive or even meaningful finish line in real-life money management. How real life people fare in net dollar terms is defined over the course of full market cycles (which includes the expansion and contraction phases) and not in just in one, two or even four year’s of numbers.

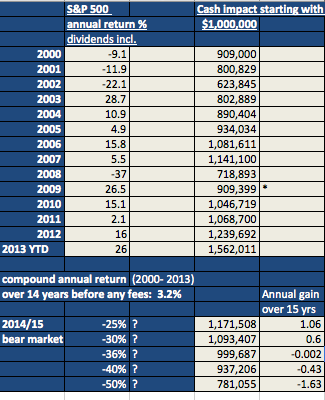

You see a little mentioned truth haunts stock perma-bulls today: they needed an extra-ordinary price recovery over the past 4 years, just to try and recoup the staggering sums their followers and clients lost in the 50% down cycles of 2000-2002 and 2007-2009. Moreover even now–with the above average cyclical rally of 170% from the 2009 bottom–the truth is that the S&P 500 has gained just 3.2% a year (before any investment fees) since this secular bear began in 2000. And that’s only if investors didn’t miss out on any of it! In truth most were inclined to buy near tops and sell in terror near bottoms and therefore have dramatically under-performed even the 3.2% a year gross returns of those few brave souls who were not scared out after capital losses.

This means that on a total return basis over the past 14 years, those who avoided stocks and invested in just bonds, bank deposit certificates and cash equivalents have earned higher returns. After adjusting for the extreme risk and volatility endured by stock holders to try and garner that meager 3.2% a year, equities have far underperformed fixed income since 2000. Not only that, but from here, even after 5 years of double digit annual increases, stock holders cannot afford another bear market or they will lose most if not all of the gains from all of their pains over the past 15 years. Believe it or not. Here are the net dollar effects on $1,000,000 invested 100% in US stocks since December 31, 1999 (generously assuming no investment costs):

*Even following the dramatic bounce in March 2009 for a 26% recovery by the end of the 2009 calendar year–including dividends received, equity returns were negative over the 10 long years from Dec 31, 1999 to Dec 31, 2009, with 1 million being worth just $909,399.

As further shown in the bottom 5 rows of the chart above, if we now see a relatively mild bear market of just -25% from here, the net return from holding US equities over 15 years will be 1.06% gross a year including dividends, and a bear market of -36% will reveal today’s super confident bulls as having negative nominal returns (never mind after fees, or after inflation, just nominal returns will be negative) as that same 1m invested in Dec 1999, will have shrunk to **$999,687 once more.

As a comparison, the Canadian TSX fared somewhat better on the commodities boom than the S&P from 2000 to 2007, and then fared worse on the commodities bust ever since–the TSX has recovered just 79% of its 2008 losses to date–with gross annual returns now since December 31, 1999 of 3.6% a year including dividends (and before any fees). A bear market from here of -25% would reduce that to a gross gain of 1.43% a year, and a bear market of -40% would reduce that to negative returns over 15 long years.

Now we understand why equity perma-bulls cannot afford to look down or see a bear market ever again.