Algos are wildly flailing this afternoon looking to churn any trend off the Bernank’s taper start. Round and round trades all go, where they stop nobody knows in this circus we call financial markets today. But after all the fancy talk, the FOMC’s monetary message this afternoon comes down to simply this: less. Near zero rates to continue indefinitely. QE to continue but 10 billion less of it starting in January toward a hoped for end point in 2014. The most relevant point here is that starting to taper is two moves in reverse now away from adding more accommodation. This makes a shift back to more QE (as some had hoped) less accessible should the economy continue to disappoint.

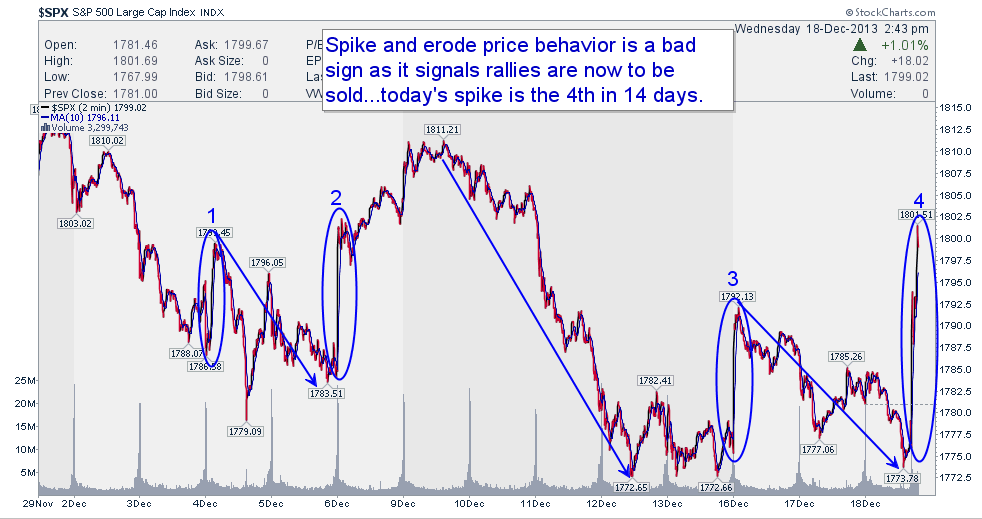

As the press conference wraps up, we have US dollar winning the arm wrestle to move stronger on this news, which makes some sense. Precious metals are flat so far, but lower on this news would seem likely. The two main benefactors of QE are so far sending mixed messages on this announcement: US bonds are selling off on the prospects of less liquidity pumping, but North American stocks remain spiked on the news. We have seen this pattern several times already this month though, where stocks spike and then fade once more shortly thereafter(shown below). We shall see if this time is different…but no matter how the bulls wish to minimize today’s taper, no matter how much the Fed assures us that taper isn’t tightening–at the end of the day–less QE is not more–no matter how much they churn it.

Source: Cory Venable, CMT, Venable Park Investment Counsel Inc.