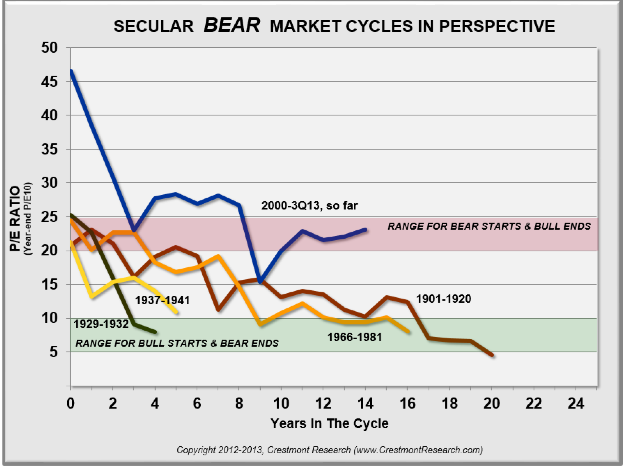

Good overview update from Crestmont Research’s Ed Easterling, reminding us that wishful thinking, hopes and all the Fed liquidity in the world cannot change the fact that the secular bear that began in 2000 has much further to go before stock valuations are low enough to launch the next secular bull market once more. See: Nightmare on Wall Street: this secular bear has only just begun.

Money for nothing indeed, as shown in Ed’s chart above, 4 trillion of QE pumping over the past 3 years and counting has only served to reflate bubble prices and suspend the progress needed toward the single digit stock valuations and opportunities that will usher in the next secular boom. Far from saving investors and the economy with their continual interventions, the Central Banks of the world are prolonging the hardship of economic pain and non-productive asset allocation. They need to get out of the way and let free market forces restore investment value.

Follow

____________________________

____________________________

Danielle’s Book

Media Reviews

“An explosive critique about the investment industry: provocative and well worth reading.”

Financial Post“Juggling Dynamite, #1 pick for best new books about money and markets.”

Money Sense“Park manages to not only explain finances well for the average person, she also manages to entertain and educate while cutting through the clutter of information she knows every investor faces.”

Toronto SunSubscribe

This Month

Archives

Log In