The commodities super cycle and Canada’s rock solid (rocks and trees that is)economy were two of the greatest stories ever sold to the investing public over the past decade. And the Canadian dollar was a huge benefactor as capital flows poured into the country from 2003 to 2008. But then just when it was least forecast by the consensus, the capital tides turned with the bursting of the global credit bubble and demand turned down. The trouble is too many people, companies and business models were heavily invested in the belief of a never-ending up cycle. When QE mania began in 2010, resources and the Canadian dollar rebounded quickly on speculation that liquidity could cure demand demise. When it clearly did not, investment money began to leave again by 2011, even as investment banks and hedge funds merrily manipulated, stockpiled, ‘played’ in commodity, currency and futures markets free from meaningful controls or regulation.

Recently, a surge of interest and outrage at “market makers” and their speculative activities has spawned a new round of regulation and restrictions, prompting many participants to pack up their algos and go home. If they cannot lever up unrestrained and unaccountable, then they aren’t keen and the Loonie has fallen along for the ride–down more than 12% in the past 2 years, more than 16% since the bubble peak in 2008.

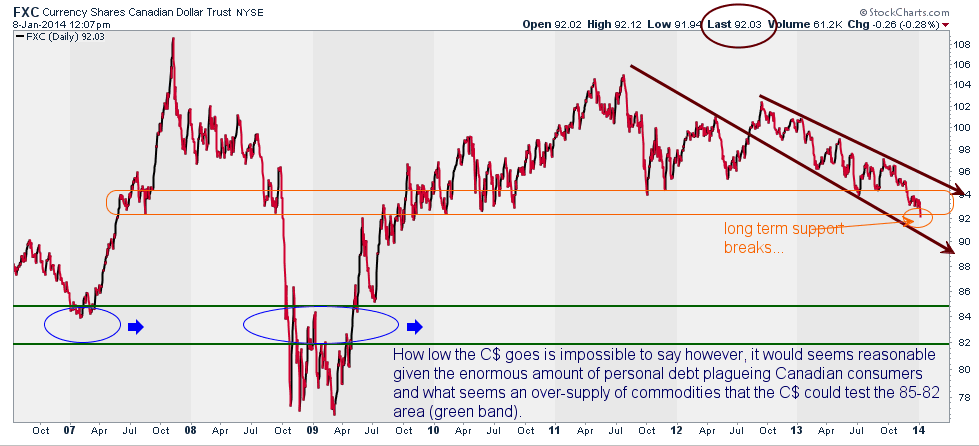

This week it failed to hold the next level of key support as shown in the chart below, making further downside likely. This will help some of Canada’s manufacturers, but not most commodity producers(as a strengthening U$ moves commodity prices lower, and some input costs higher) nor businesses or investors who are unable to recognize and navigate the deflationary dynamics of the post-consumer-credit-bubble world.

Source: Cory Venable, CMT, Venable Park Investment Counsel Inc.