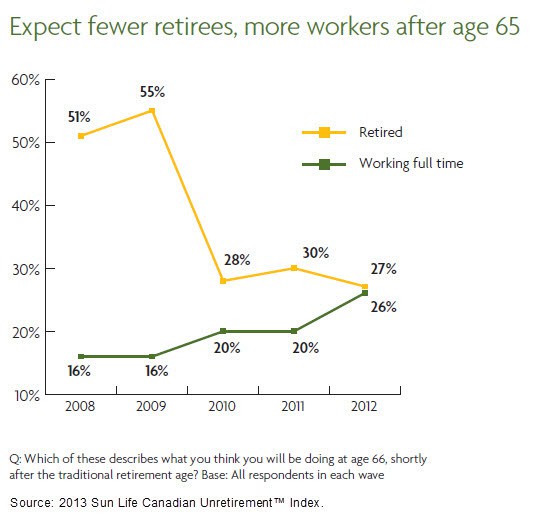

Fifteen years of under-saving and over-spending amid a secular bear market for stocks, poor investment management, plunging interest rates and anemic dividend yields are all taking their toll on the retirement plans of baby boomers today (now aged 50 to 68). In the late 90’s, “Freedom 55″ was the financial marketing slogan that inspired confidence and dreams of leisure. Today that dream has sobered up to math and more realistic plans. As captured in the graph below, before the 2008 financial crisis, 55% of Canadians expected to be fully retired by age 65. Today that number is less than 27%. The top reasons Canadians gave for working past 65 in 2008 were about enjoying their work and wanting to stay mentally active. Since 2010, the top reason has been “to earn enough money to pay basic living expenses.”

Just 27% of working Canadians expect to be retired at 66. That’s the key finding of this year’s Sun Life Canadian Unretirement™ Index. Almost the same number (26%) believe they’ll be working full-time at 66. Another 32% say they’ll be working part-time.

Five years ago, when we asked the same question in the heat of a global financial crisis, 51% of Canadians said they expected to be retired at 66. Interestingly, the percentage was even higher a year later. In 2009, 55% of Canadians expected retirement by 66. This year’s result is less than half that number.

While the data doesn’t tell us why attitudes began to grow more negative after 2009, the timing does coincide with a growing realization that the recovery following the 2008-2009 recession was relatively weak. After a period of optimism in 2009 — during which Canada’s economy was held up as a source of stability in a volatile world — it had become clear by 2010 that economic growth across much of the country would probably be soft for the foreseeable future.

See: Unretirement ahead for more than half of Canadians.

The reality of math can jolt hard to those who have not been paying attention or buying and hoping on the advice of financial sales firms. But accepting reality and getting focused on practical steps to find, extend or supplement employment or business income through active pursuits is a wise and necessary part of most plans today. Even those who have several million dollars in savings are noticing a significant pay cut if trying to live solely off their retirement portfolios today. In more average financial conditions, conservative income investments could yield 5 to 6% a year and thereby reasonably sustain retirement withdraws of 5% a year (50K a year off $1m). Today those same instruments are paying 2 to 3% a year, and thus can only reasonably sustain withdrawals of about 2% a year without consuming capital (so 20k a year off $1m).

Although commonly advised by financial advisers, ratcheting up investment risk and equity allocations to try and force more passive income out of life savings is a very dangerous idea at the best of times, and especially in present conditions.