The Canadian dollar soared with the commodities bubble from 2002 to 2007, imploded with the credit bubble and global recession in 2008, rebounded with QE hopium into 2011 and has been falling steadily with global growth ever since.

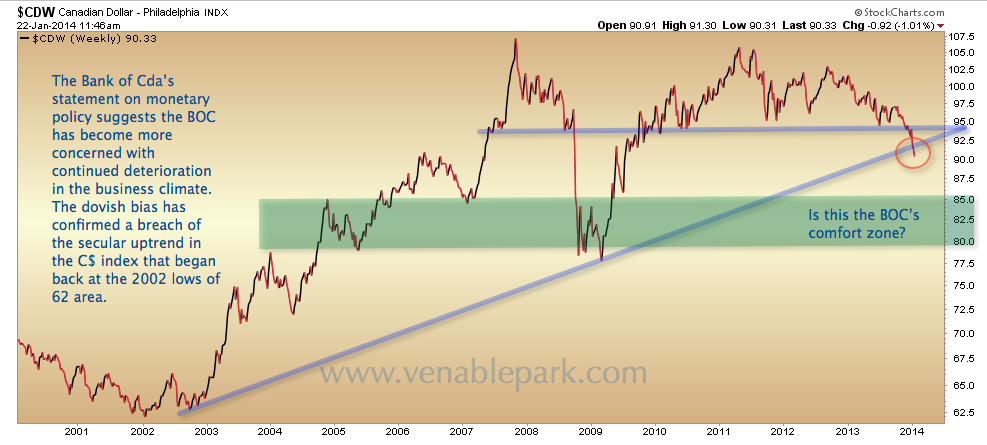

As captured in the chart below, last week the C$ Index broke below its secular support in place since 2002 around $92. Today as the Bank of Canada warned of slowing growth and falling inflation, the loonie confirmed the thesis and broke below $90. Next support level is in the $82 area as marked below. But if this secular mean reversion story holds, and the global economy continues to disappoint from here, we could see the C$–a currency of global risk speculating–fall back below $70 in the months ahead.

Hard for most to believe I know. But the seeds of this down cycle were sown in the extreme optimism and over-confidence in Canada (and global demand) built during the 2002-07 credit boom, and excessive domestic debt building in Canada since. It’s pay back time.