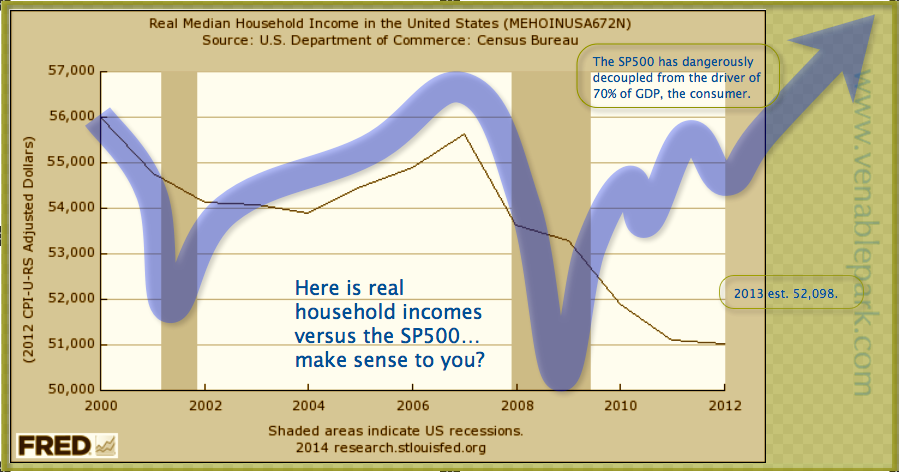

So long as the consumer is pouring on debt, spending can continue longer than reason would suggest. But once the consumer has committed financial suicide and is buried in debt payments, income growth reasserts itself as the defining force on consumption, corporate sales and the consumer dependent economy. And in that regard, this chart of US household income since 2000 shows that consumers have less real income today than they did in 2000 and 2007. Less income and more debt payments than ever before equates to less consumption over the next few years. It also highlights the precarious perch of the S&P 500 now recklessly decoupled from the real economy and teetering far above demand/sales support.

Follow

____________________________

____________________________

Danielle’s Book

Media Reviews

“An explosive critique about the investment industry: provocative and well worth reading.”

Financial Post“Juggling Dynamite, #1 pick for best new books about money and markets.”

Money Sense“Park manages to not only explain finances well for the average person, she also manages to entertain and educate while cutting through the clutter of information she knows every investor faces.”

Toronto SunSubscribe

This Month

Archives

Log In