Nope not about the weather…home sales have fallen the most in the west–no polar vortex there.

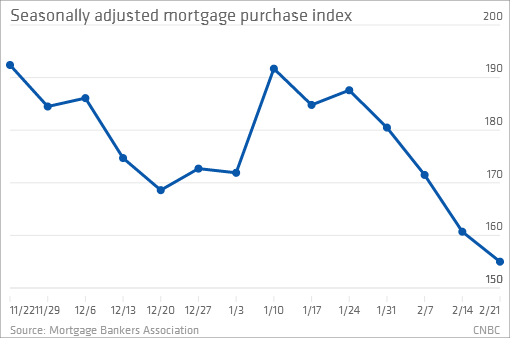

Mortgage applications to buy a home fell last week to the lowest level in nearly two decades, according to a weekly survey from the Mortgage Bankers Association.

The report is a clear sign of weakness in buyer demand heading into the usually busy spring housing season.

“Purchase applications were little changed on an unadjusted basis last week, but this is the time of a year we would expect a significant pickup in purchase activity, and we are not yet seeing it,” said Mike Fratantoni, the association’s chief economist.

“We’re in a critical juncture in housing, and it started when rates went up a small 1 percentage point back in June,” housing analyst Mark Hanson told CNBC on Tuesday. “We’re going from an investor-led housing market to an end user-led housing market, and that’s creating a lot of problems.” See: Mortgage applications at lowest level in 2 decades

That is a problem indeed. Since end-users (the masses) have been largely left out of economic “recovery” since 2008…they have very little ability to buy houses today, especially at now higher prices and higher mortgage rates. Who is going to provide the exit capital “liquidity events” for all the investors who piled into reality markets the past few years?