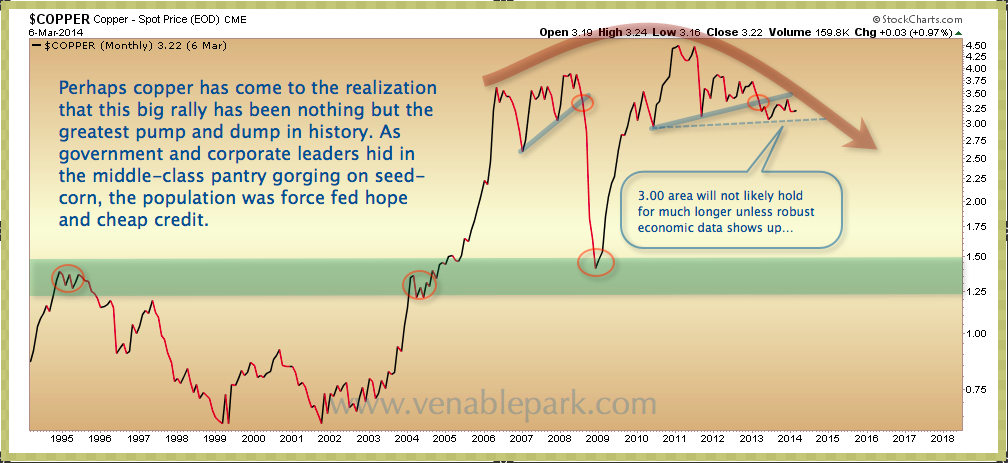

The double and triple pledging of a multitude of metal deposits the past few years reminds me of the gold cart fraud in US banks in the 1800’s. In order to control loan growth, banks were required to maintain a fixed ratio of physical bullion as backing in their basement vaults. This was meant to stop them from becoming too greedy and over-levered. Not to let a little thing like responsible restraints on their growth get in the way, the banks ingeniously devised a gold cart on wheels that could be moved from vault to vault ahead of the auditors. In this way they were able to side side step lending controls and fraudulently pledge the same gold base multiple times over among the group. The result was predictable..rapid growth in loans and profits and then–yet another spectacular financial collapse that shuttered banks and evaporated customer deposits. In the 2000’s, this same multiple pledging model became the back bone of the derivatives market that blew up the global banking system. But since the banks were bailed out by governments and central banks everywhere the past 5 years, they were of course able to go right back at it, levering on leverage. China has been a poster-child for this excess leverage model; and now the inevitable unwind has begun. Copper is leading the way lower, having fallen through the trend line at 3.00 this week, long term support marked below is the 1.50 area.

CNBC’s Steve Liesman and Michelle Caruso-Cabrera provide insight into the sell-off in copper, and the impact of a weaker Chinese economy on the U.S. economy. Here is a direct video link.

All of which underlines the garish disconnect today between the stock market of the world’s second largest economy, China, fathoming its 2009 lows once more, and the S&P 500 at all time highs…Extreme capital risk anyone?