A client sent me an article clipping today from an April 1864 Scientific American issue, entitled, Vultures Everywhere. See if any of this rings familiar to recent times:

“One of the most alarming signs of the times in which we live is the extraordinary and villainous speculation now rife in Wall Street, in the shape of gold and other mining operations. Bogus companies are forming every day, which foundations are the baseless fabric of a vision. We warn the people to beware of these swindlers–they should shun them as they would the gambling-halls of the city. These vile schemes are incubated and hatched in the region of the Stock Exchange, and are designed to entrap the innocent and unwary. Every one of them ought of be indicted by the Grand Jury, and the guilty swindlers sent to Sing Sing.”

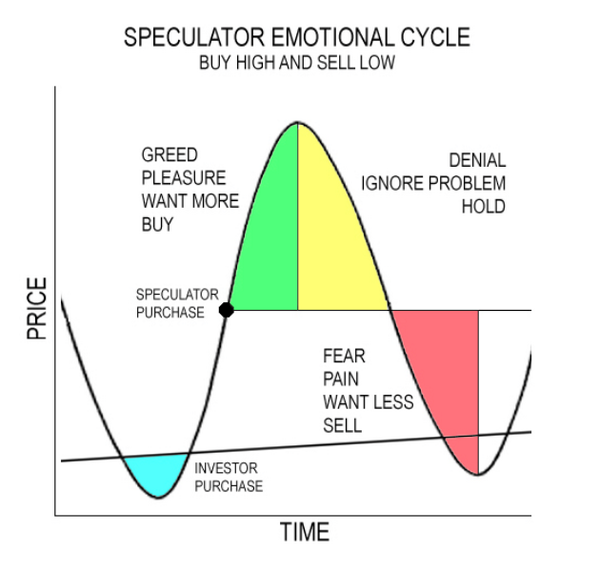

The more things stay the same…only today the speculation has been far beyond just mining shares. The financial world is set up to suck in and prey on the weak and undisciplined. The only way to beat them at their game is to do exactly the opposite of what they are selling and recommending. When the risk sellers are looking genius and all-powerful, we are wise to stand clear and patiently devise our own plan of execution. When the risk-sellers are once more imploding in their leverage and hubris, those who are ready and liquid take charge buying assets off of failing hands and fools. The below chart summarizes the cycle perfectly. This particular cycle the last great investor opportunity was in the spring of 2009, and the black dot signifying the speculative phase kicked off in mid-2010 when QE-mania spurred unrealistic faith in the power of Central Banks. Investing is the quintessential mental game of tortoise and hares. Are you set up to fail with the hare masses or prevail with the tortoise few?