Today the US Fed starts yet another round of deluded meetings to much media circus. Deluded because they have exhausted their experimental arsenal of monetary policy long ago, and yet they still talk as if they are command control on the business cycle. The HFT firms love the chum and will surf the headlines in their usual churn and burn through capital markets to trick, slice and dice participants faster than the eye can blink.

The fact that there are now 13 exchanges and 40 dark pools in the US alone today stands testament to the madness and mayhem we are dealing with here. Exchanges and news wires are selling preferred proximity and advance access to a select few while brokers are selling their client order flow to dark pools and HFT frontrunners. Other participants are running the table on belief in Fed power to perpetually inflate asset prices (contrary to all historical evidence); virtually none of present participants are doing so in any risk-conscience, legitimate investment sense.

Here is Michael Lewis explaining the rise of dark pools since 2007 (Flash Boys, p 85):

“These dark pools contained the murkiest financial incentives in the new stock market. Goldman Sachs and Credit Suisse ran the most prominent dark pools. But every brokerage strongly encouraged investors who wanted to buy or sell big chunks of stock to do so in that firm’s dark pool. In theory, the brokers were meant to find the best price for their customers. If the customer wanted to buy shares in Chevron, and the best price happened to be on the New York Stock Exchange, the broker was not supposed to stick the customer with a worse prices inside their dark pool. But the dark pools were opaque. Their rules were not published. No outsider could see what went on inside them. It was entirely possible that a broker’s own traders were trading against the customers in the dark pool. There were no rules against it. And while the brokers often protested that there were no conflicts of interest inside their dark pools, all the dark pools exhibited the same strange property: a huge percentage of the customer orders sent into a dark pool were executed inside the pool…the Goldman Sachs pool–to take one example–was less than 2 percent of the entire stock market. So why did nearly 50% of the customer orders routed into Goldman’s dark pool end up being executed inside that pool–rather than out in the wider market.”

The obvious question is why in the world would our regulatory system charged with maintaining market stability, transparency and fairness ever tolerate the operation of one ‘dark pool’ let alone 40? The answer of course is that the financial lobby has simply bought off all the watch dogs the past 7 years.

Anticipating another round of calming comments from the Fed, risk markets are off to the races again this morning (it is another magic Tuesday after all).

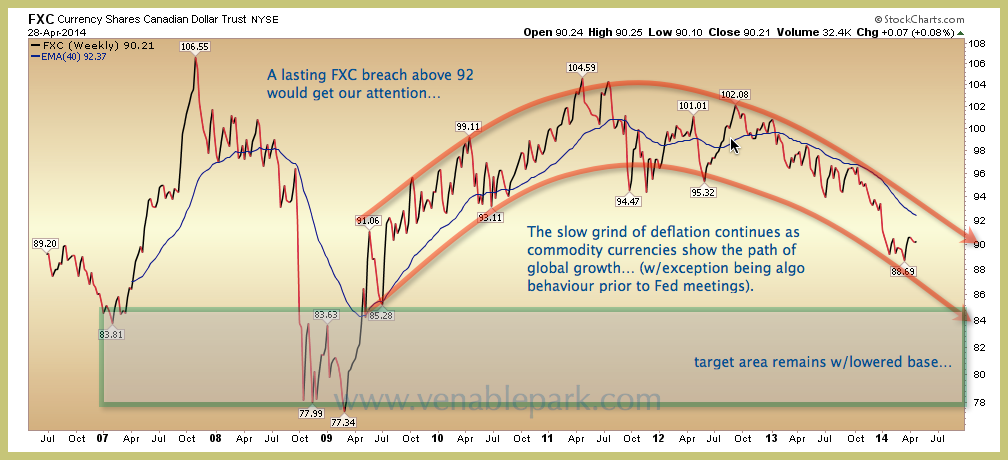

The Canadian dollar has popped up along for the ride out of the gates. But as shown in the updated chart below however, the trend so far remains down for the loonie in sympathy with the still weakening global economy juxtaposed against the most expensive stock market valuations ever in human history. (As pointed out by John Hussman this week, the median price to revenue multiple for the S&P 500 is now higher than at the tech wreck peak in 2000.)

All we know for sure is that this madness too shall pass, and when it does, the downside is destined to be once more catastrophic for participants and the overall economy who remain still weakened from the last two financial market meltdowns.