Another look at the bearish small cap divergence is found in the below chart, showing a ratio of the Russell 2000 small cap index over the S&P 500 index since 2006. Each time we saw this break down since 2010, the Fed raced to the rescue with another round of QE; this time they are tightening tapering, not adding more.

The 10 year Treasury yield is so far confirming the small cap vote for slower growth ahead.

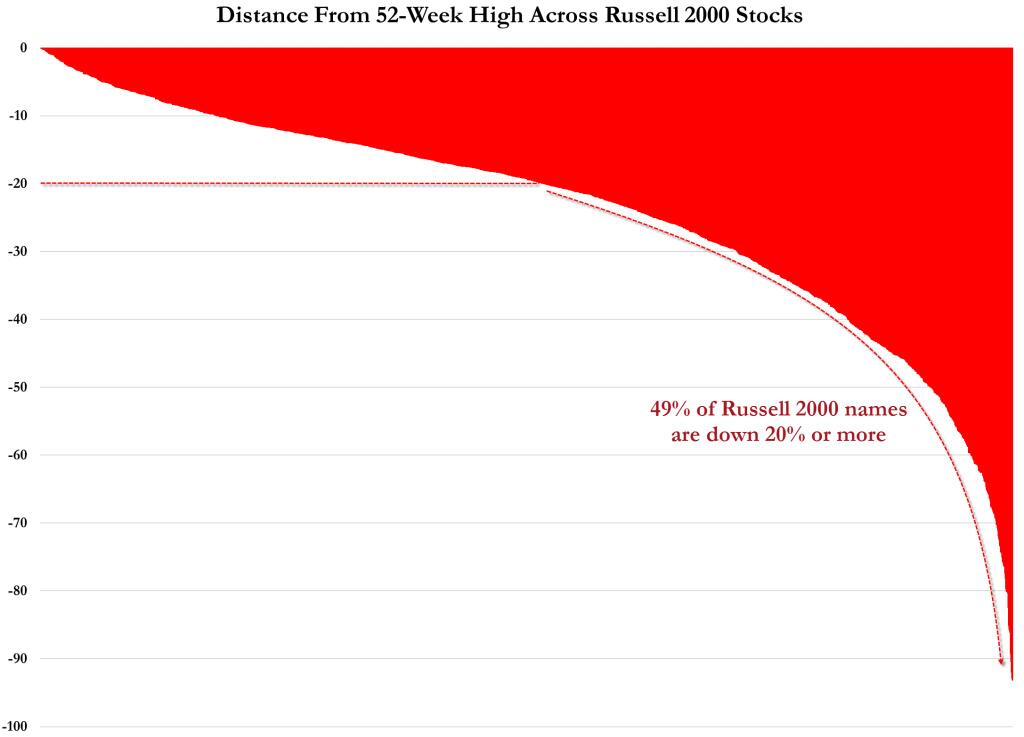

Sure HFT gamers don’t care about sales, income, jobs, economic growth or valuations, but alas, the real world must. The following chart courtesy of John Hussman shows that 49% of the Russell 2000 stocks have now entered a bear market with losses of 20% or more so far.

Follow

____________________________

____________________________

Danielle’s Book

Media Reviews

“An explosive critique about the investment industry: provocative and well worth reading.”

Financial Post“Juggling Dynamite, #1 pick for best new books about money and markets.”

Money Sense“Park manages to not only explain finances well for the average person, she also manages to entertain and educate while cutting through the clutter of information she knows every investor faces.”

Toronto SunSubscribe

This Month

Archives

Log In