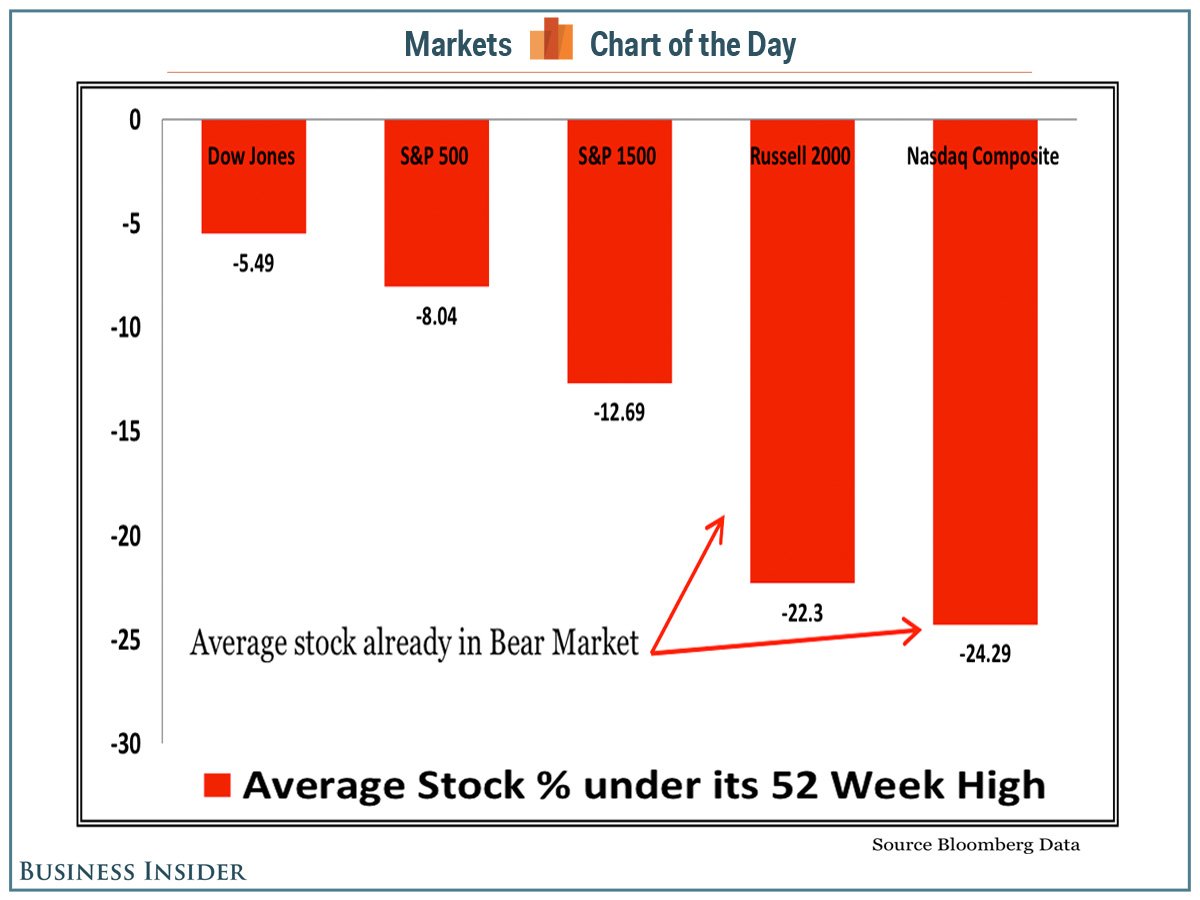

Today’s rebound notwithstanding, the headline levels are glossing over a bear market already underway in many stocks…

Most market-watchers prefer the S&P 500 over the Dow Jones Industrial Average. But the fact that the S&P 500 is down just 1% from its all-time high of 1,897 belies the fact that many stocks in the index and in the market as a whole are way down.

“When we examine breadth in terms of new highs, more specifically stocks that are in ‘striking distance’ to a new high, we see a completely different picture,” writes J.C. O’Hara, of FBN Securities. “Often at the end of bull markets, large cap stocks continue to rise and the smaller stocks begin to flatter.”

The S&P 500 is cap-weighted, which means larger companies like Apple and ExxonMobil have a much larger impact on how the index moves.

“High cap stocks influence the averages more thus can mask internal weakness,” continued O’Hara.

O’Hara’s research found that the average S&P 1500 stock is down by more than 12% from their recent 52-week highs. The average stocks in the Russell 2000 and Nasdaq Composite are down by more than 20%, which means you can say they are in bear markets. See: The average stock is in a bear market