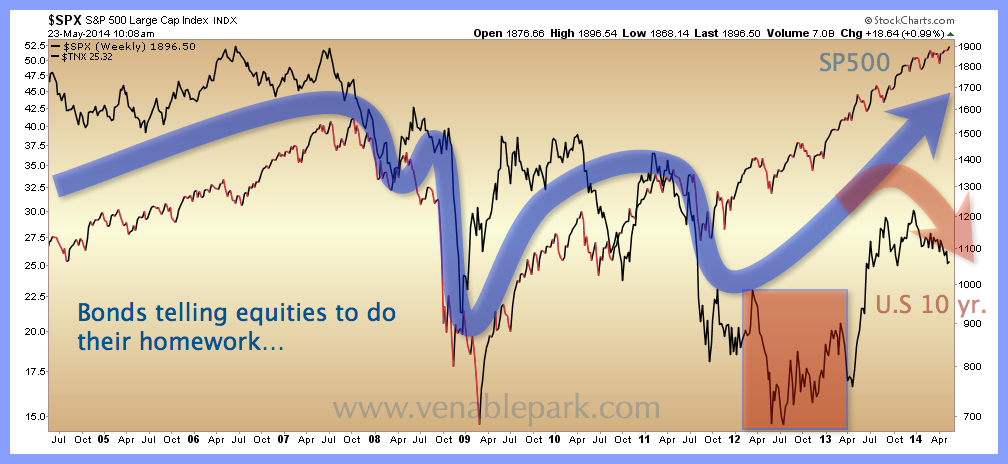

For a couple of years off the bottom in 2009, bond yields believed the economic promise of growth buoyed by fiscal and monetary stimulus. But then in 2010, bond yields noted that global growth was declining once more and yields and then commodity prices broke faith with the narrative of economic recovery and inflation and turned back down. Equities conceded too for a while, declining into the fall of 2012 before Central Banks gushed reckless liquidity into risk-traders over the past 18 months. Bond yields (shown below in black with the S&P in red) along with emerging markets, small caps, tech and previously loved momentum stocks, are all not confirming US large cap (HFT rich) euphoria year to date.

Follow

____________________________

____________________________

Danielle’s Book

Media Reviews

“An explosive critique about the investment industry: provocative and well worth reading.”

Financial Post“Juggling Dynamite, #1 pick for best new books about money and markets.”

Money Sense“Park manages to not only explain finances well for the average person, she also manages to entertain and educate while cutting through the clutter of information she knows every investor faces.”

Toronto SunSubscribe

This Month

Archives

Log In