Now that the ‘borrow your brains’ out credit cycle is in retreat, aspirational wealth products and services have a problem: household incomes for all but the top 1% have declined back to 1999 levels. Here are some of the latest stats, see, US consumers languish in the trap of luxury:

- The bottom 20% of households in the US earned $20,599 in 2012, a remarkable 9.7% lower in real terms than 8 years ago in 2006.

- The median household income fell 7.1% to $51,017 over the same period.

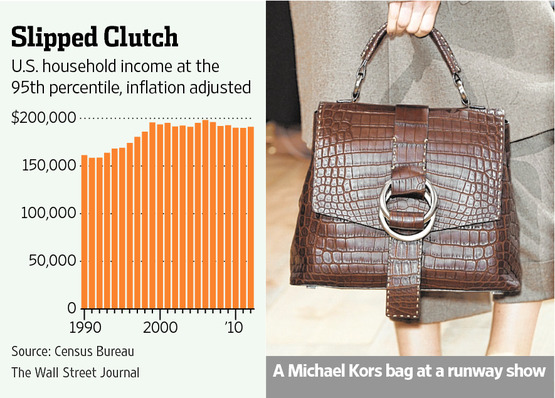

- Even the top 95th percentile households–those earnings more than everyone but the top 5%–were earning $191,156 in 2012 about 3.5% less than their real income in 2006, and as shown in this chart.

The buying power of those under 34 has fallen even more with the majority under-employed and/or heavily indebted, a down-shift in material acquisitions and aspirations is inevitable. It is quite typical for young people to now put off marriage, household formation and child-bearing well into their 30’s and even beyond. This is also showing up in reduced demand in most things, from expensive activities like golf (as explained here) to life insurance. Cash-strapped singles are understandably not buying health and life insurance products or mutual funds, see: Death plans delayed by Millennials, pressuring insurers.

The buying power of those under 34 has fallen even more with the majority under-employed and/or heavily indebted, a down-shift in material acquisitions and aspirations is inevitable. It is quite typical for young people to now put off marriage, household formation and child-bearing well into their 30’s and even beyond. This is also showing up in reduced demand in most things, from expensive activities like golf (as explained here) to life insurance. Cash-strapped singles are understandably not buying health and life insurance products or mutual funds, see: Death plans delayed by Millennials, pressuring insurers.

Food for thought in reflection on ways to better share the wealth and rebuild the weakened 99% of households today. Elizabeth Warren offered some perspective in her senate speech on the minimum wage legislation in April.

Like it or not, companies that are celebrating lower labor costs and record profit levels today, can either figure out ways to share the wealth with their employees more or continue battling each other over a smaller and smaller pie of consumers and sales.

Senator Warren spoke on the Senate floor on April 30, 2014, after a vote to advance minimum wage legislation was blocked by Republicans.Here is a direct video link.