Steven Levitt and Stephen Dubner, co-authors of “Think like a Freak”, says stock pickers are “as good as a monkey with a dart board”. Here is a direct video link.

Truth-telling like this undermines the entire CNBC business model which they tout as ‘direct access to experts and insiders so viewers can know what stocks to buy’. In reality it is direct access by the insiders and sponsors to a captive and gullible audience so that guests/sponsors can sell their various “investment” products.

And then of course there is all the shooting-fish-in-a-barrel money for the broker/dealers to make when they sell their client order flow to predatory HFT players so they can make riskless profits off the dumb money trying to execute all these buy ideas.

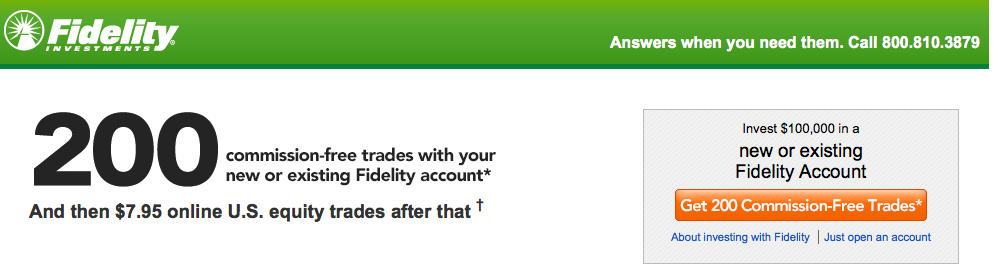

The latest iteration of on line trading offers gives some perspective. Where in 2000 the pitch was all about $10 trades, then $8, then $5….today we see offers like the latest from Fidelity: “200 free trades when you open an account”. This reminds me of Gillette’s new shavers that come out with one more blade each year and call it a revolutionary product. Except this is much more dangerous for customers than a closer shave… this is all about financial scalping.

How in the world can a broker make money on free trades? Why by selling your order flow for 100’s of millions of dollars to predators who can front-run and abuse you behind your back of course. See: SEC probing brokerages for handling of retail orders:

“Some of the biggest retail brokerage companies are Charles Schwab Corp., TD Ameritrade Holding, Fidelity Investments’ Fidelity Brokerage Services and E*Trade Financial Corp, which can get paid $100 million a year or more for selling their orders.”