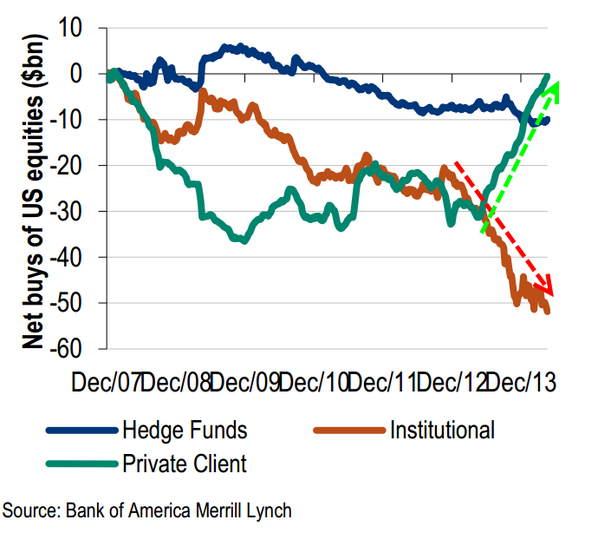

I guess you do have to hand it to those bankers; maybe they are brilliant after all. They wagered that if they could keep pumping up the stock market long enough via QE and creative accounting manoeuvres, the little guys who had fled in tatters in 2007-09 would finally be sucked back into the fray at cycle highs once more. Its a maniacal cycle to witness: central banks pump “free” (taxpayer-backed) liquidity into the investment banks and hedge funds off the market bottom, which allows them to buy (when price risk is the lowest) from all the retail investors who are selling in panic with huge losses. Then after these “strong hands” have enjoyed every conceivable concession and advantage, they take profits and raise cash by selling down their equity holdings back onto the retail crowd just as price risk moves back toward cycle highs. Waiting to repeat the cycle all over again. Seducing and then slaughtering sheep is a very lucrative business model indeed.

Follow

____________________________

____________________________

Danielle’s Book

Media Reviews

“An explosive critique about the investment industry: provocative and well worth reading.”

Financial Post“Juggling Dynamite, #1 pick for best new books about money and markets.”

Money Sense“Park manages to not only explain finances well for the average person, she also manages to entertain and educate while cutting through the clutter of information she knows every investor faces.”

Toronto SunSubscribe

This Month

Archives

Log In