Geopolitical tensions have been goosing up oil prices of late on top of what were already QE-juiced and HFT escalated levels. This has brought many of the usual oil perma-bulls into attention once more.

A US client recently forwarded an RBC analyst report marketing piece (you can read it here) where RBC economists outline their expectation for a continuation of very strong growth forecasts for Alberta–the province that holds more than 95% of Canadian oil reserves. The familiar thesis espoused is that since the global economy is rebounding (in their view), Alberta will continue to invest in tons of production and sell lots of oil and gas for as far as their eyes can see.

And short-term, they may be right. Perhaps oil prices will remain elevated on geo-political concerns and perhaps this will maintain profit margins for Alberta producers and drive tax revenues into provincial coffers well into 2015. On the other hand, high prices in oil have traditionally been a reliable cure for high prices in oil; spawning the self-correcting forces of alternatives, innovation, substitution and reduced consumption. And one would be wise to note that RBC economists made a similar rosy (and unfortunate) forecast in April 2007 as shown here: See: Canada’s economic growth to pick up pace in 2007, says RBC Economics. Forecasting strong US growth for 2008 of 2.9%, RBC explained:

“With a strong global outlook and energy prices remaining high, demand for Canadian exports is likely to pick up, while the pace of import demand slows alongside the modestly weaker Canadian dollar. Overall, the drag from the trade sector is expected to trim only a tenth of a percentage point from 2007 real GDP, a marked improvement from the one and a half to two percentage point impact of the previous two years.”

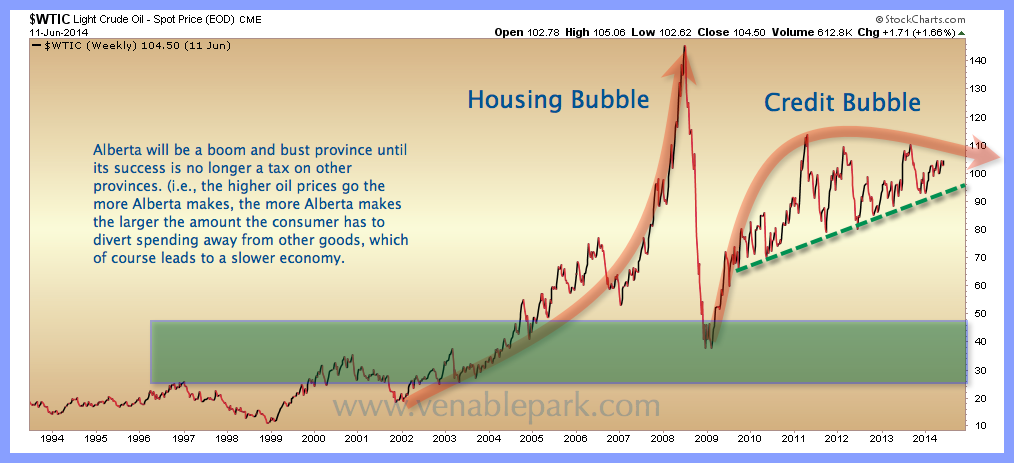

As we know however, far from expanding 2.9% in 2008, the US economy began to contract a few months after this report into an 18 month recession that took the global economy into the deepest decline since the 1930’s. Oil prices crashed from $147 a barrel in June 2008 to less than $50 a barrel by the spring of 2009.

Perhaps there is another side to RBC and company’s perma-bullish oil/Alberta/underwriting for the oil industry story. My partner Cory Venable offered a rare alternative assessment, and I thought it worth sharing here:

“It would seem credit market dislocations and their inevitable meltdowns are not a point of focus for these folks. I guess for them mentioning the obvious would have been a drag on RBC trading/investment revenues.

Despite the conflict though, it’s amazing they didn’t mention U.S or Cdn. housing, credit abuses, household debt to income levels and the associated risks to equities and home values. The Great Recession of 2008/9 was either not on the radar (doubt it) or it wasn’t in their best interest to mention it.

Forward to today, given their 2008/9 experience, you would think NOW, would be a good time to save face and mention Canadian household debt that has gone on to stratospheric levels well beyond the U.S peak and the impact that could have on consumption levels. But that again assumes bank/brokerages manage risk to family wealth. Sadly for a bank, consumers never have enough debt or leverage and there’s never a rainy day on the horizon and you’re always richer than you think…that is, until the interest payments stop coming in, then they get a little concerned and call your loan.

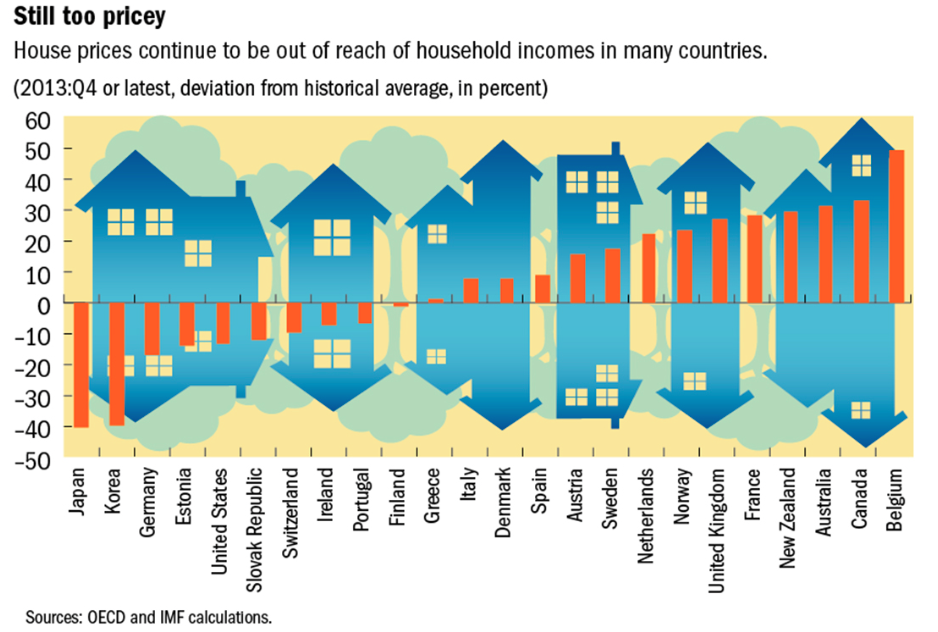

No mention of Canada having one of top 3 least affordable housing markets in the world today either…

One part of the article was particularly disingenuous (Alberta will outgrow…), if the Canadian consumer now holds record debt, enticed by reckless monetary policy, what is the driver of Alberta’s higher potential growth rate when the other provinces that helped propel said growth can no longer consume at the same pace?

Never mind the 80+yr high in oil reserves currently held and the fact that during the glory period 30 yrs ago that RBC mentions so favorably, forgot to add that oil prices soon after, collapsed from $38.34 in 1980 to $10.40 in 1985…with a 2 year recession within that period which took Alberta and every other province with it.

Alberta’s oil industry, I’m quite sure, will make it through but the size and shape of the industry will be forced to change as alternative sources become far more competitive (eg., solar, is now as cheap to use as coal). I do hope the province recognizes the inevitable change happening right in front of them, sadly, that change would require political will and leadership: two commodities that are extremely rare these days.

What will Alberta’s oil industry look like when oil reverts….is the question RBC should be considering. Here is my chart of $WTIC (West Texas Crude) since 1993, with long-term secular price support marked at the green band:

Food for thought…