In the spring of 2011, global growth began weakening from the cyclical recovery that had begun in early 2009, and stock and commodity markets turned lower once more. All over the world, Central Banks responded with trillions of monetary injections designed to arrest the contraction and encourage belief in a more extended economic recovery. Risk markets stopped falling in response, but it took nearly 2 years of sideways action, and seemingly endless promises and liquidity programs, before stocks were finally able to recover and break higher in the final quarter of 2012.

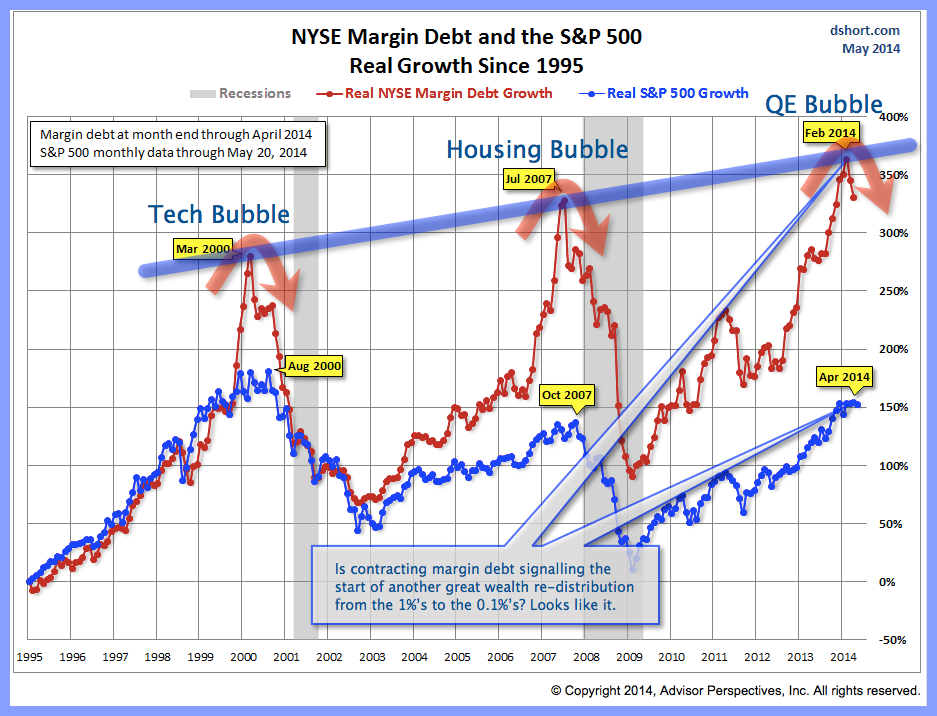

As shown in this remarkable chart below, levered risk-taking–borrowing to buy on margin (red line)–began turning lower in 2011 (as it had done at prior market peaks in both 2000 and late 2007), but then re-surged with QE inspired speculation into February 2014. Since then, the margin tide has been receding once more. It looks like Central Banks are going to need some bigger, better gimmicks to turn this mean reversion process around, because historically, as margin falls, so do stock prices (S&P in blue).