Over the years I have commented on the tendency of market commentators to start discounting or ignoring objective rulers when they register bearish measurements. We saw this in 2000 when price to earnings ratios went full nut-job and the long-always crowd started explaining why PE was no longer relevant in the tech era and why EBITDA (Earnings before interest, taxes, depreciation and amortization) was a better value ruler for the brave new world. In 2007 the same thing happened, as the logic was that insatiable Chinese demand meant that traditional gauges of growth and value were no longer applicable. Today, it is belief that zero interest rate policies have left people with nothing to do but to toss their life savings into slot machines with hope that they might hit a jack pot before they go broke (again).

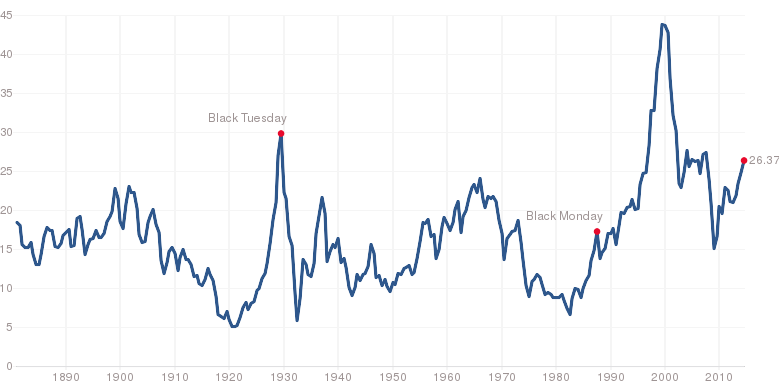

Robert Shiller’s CAPE (average cyclically adjusted price to earnings ratio for the previous 10 years) is one of several objective rulers that have stood the test of time since the 1800’s. Today the CAPE reading is 26.37. As shown in the chart below, the CAPE has only been at this level or higher in 1929, 2000 and 2007, all just before the largest crashes in human history saw broad markets fall between 84% and 55%. Here is the chart.

With this data in mind now watch this remarkable interview with Bob Shiller as he perfectly articulates the conventional insanity of our times. Here is a direct link to his recent Daily Ticker interview.

Shiller acknowledges that a 26 CAPE today measures 59% above the long-term average of 17 and that he is “definitely concerned…it looks like a peak”. He then goes on to offer today’s conventional bipolar rhetoric that since interest rates are so low people may want to continue holding stocks with some of their savings. But then says, “that doesn’t mean that a high CAPE is not a forecast of bad performance…there could be a massive crash…but maybe stocks should still be in one’s portfolio.”

Suicide bomber anyone? Feelin’ too desperate to think or wait for reasonable odds of success? Be our guest, after you, please, I insist.

A couple of things come to mind in all of this. In recent years, Shiller has developed complex business relationships with Standard and Poor’s via their sponsorship of his “S&P Case-Shiller Home Price Index”. He has learned that sounding constructive on stocks is necessary to maintaining mainstream media coverage and stay in favor with the long-always financial industry. While not throwing out his CAPE ruler all together, Shiller has learned to hedge his comments. Yet if you strip away the “on the other hand” niceties, you hear that risk to savings has rarely ever been as high as today. And never have such extreme valuation peaks resolved themselves without a massive decline of more than 50% that took many years to recover. Other than that, things are good…bonne chance.