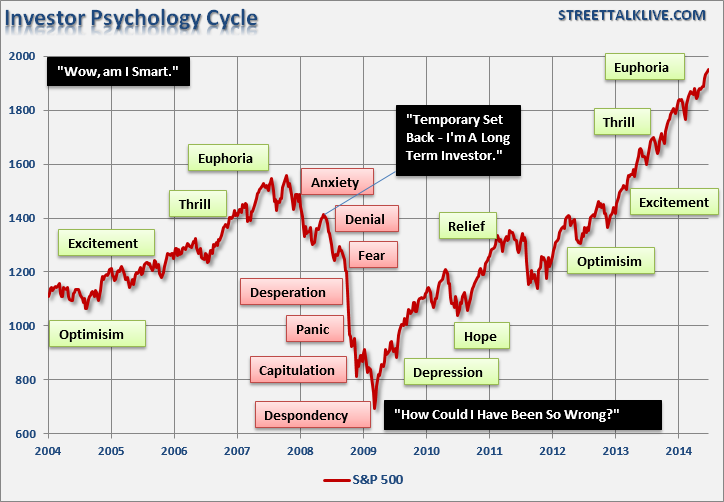

As Portugese credit markets jolt the world from the Fed’s “we got this all under our control” meme this morning, the charts in this clip and below offer a glimpse of where we are in terms of investor speculator psychology today.

Scarlet Fu examines Brean Capital Markets Peter Tchir’s hierarchy of a credit bubble. Here is a direct video link.

In the same clip Nuveen Asset Management Chief Equity Strategist Robert Doll counters with his usual perma-bullish slant for a little comic relief on this sunny July day.

What short-sighted humans always forget every 5 years or so, is that the market cycle is a cycle!! Prices go up on leverage and then come crashing down on leverage. The precise turning point is illusive and impossible to determine in advance, but the fact that it does turn down is never debatable. Unless of course, one is oblivious or works for the long-always financial industry who make their living trying to convince us that we are climbing a mountain of riches to infinity and beyond. Who’s riches is that again?