North American investment grade bond prices have rallied strongly this month, even as stocks have levitated on 3 guys computers trading. The benchmark US 10 year Treasury is nearing the next downside test at 2.4%.

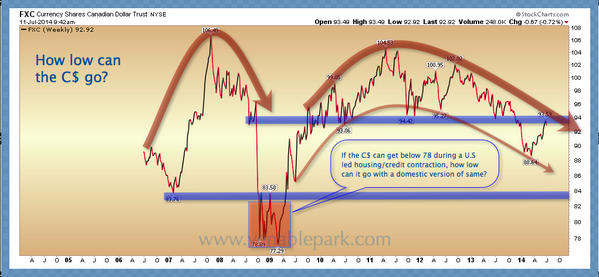

Meanwhile other key risk-on bets (that are typically correlated with equity prices) like high yield bonds below and the Canadian dollar (bottom chart) have not been feelin’ the love.

The rabid risk trade–at the highest valuations since 2000–seems to be getting a little confused as we head toward the Autumn fall. Oh well, wild-eyed speculators never get it all their way forever.