Stock floggers like to talk about how dividend yields are “attractive” today relative to cash and bonds. Except that in their imaginary world, capital risk in equities is always “contained” to fleeting “corrections of 5 to 10%” that always bounce back quickly. Sure.

In reality, the inconvenient byproduct of stock prices at the very top end of historic valuation ranges is that dividend yields are also necessarily at the very bottom end of historical ranges (the S&P 500 today is yielding less than 2%). And the larger routinely glossed over point here–not to be missed–is that stocks have no face value, no maturity date, no contractually prescribed income rate and absolutely no collateral assurances in the event of the issuer’s insolvency.

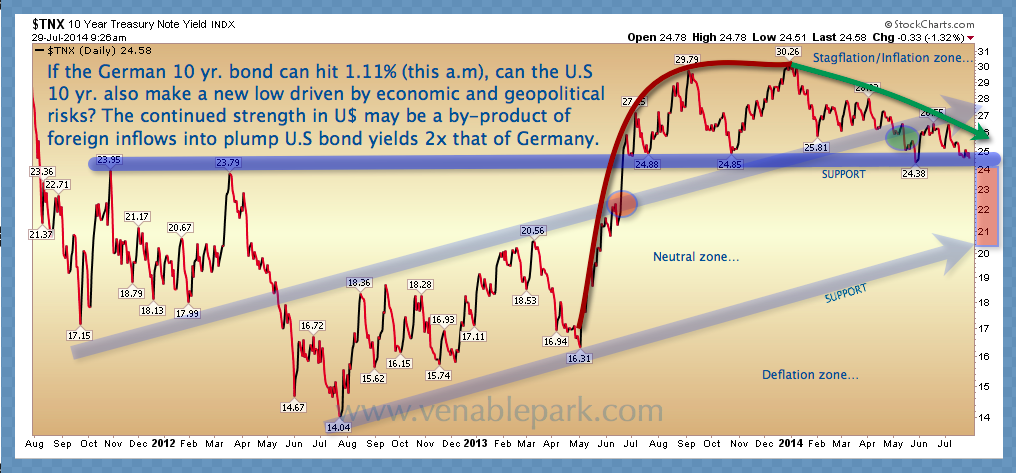

Not surprising then that as stocks have soared farther and farther away from reasonable reward for the risk prospects, international flows have been steadily moving out of emerging markets and high risk bets into the relative safety, maturity and contractually prescribed coupon payments of government bonds. In particular North American government bonds, which as we mentioned here a couple of weeks ago offer the highest yields of the 11 largest, most liquid, bond markets in the world today.

With global instability mounting and the US dollar in relative favor, the US 10-year is now revisiting support in the 2.4% range, and lower North American yields appear the path of least resistance over the next several months.