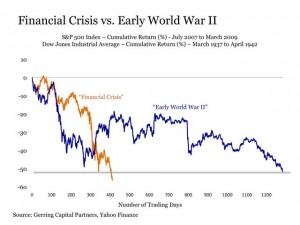

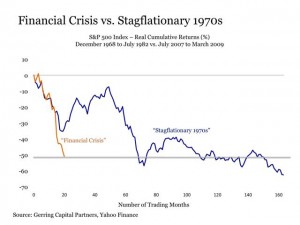

Good historical perspective today from Eric Parnell as he dispels the notion that the bear market of 2009 was an unusual, once in a lifetime occurrence, not likely to be repeated. Au contraire, in fact the loss cycle of 2007-2009 was actually modest in the context of previous secular bear declines.

See: A crisis less extraordinary and the following great charts, plotting the 2008 decline and duration against other secular bear declines in 2000, the 1970’s, 30’s and 20’s:

“…the only thing that has been truly extraordinary this time around has been the policy response. And this fact alone may be setting investors up for a far more challenging bear market experience the next time around.

…investors should not be lulled into complacency with the thought that the financial crisis was a once in a lifetime event that is not doomed to repeat anytime soon. For in reality, the bear market associated with the financial crisis was not only comparable at worst from a returns perspective, but it lasted only a fraction of the time that other major bear market investors had to endure.

What raises the stakes even further in the current environment is that nearly all of the policy bullets to protect against a weakening economy and sharply correcting stock markets have already been deployed even before the next bear gets started. For unlike in March 2009 when the Fed and other global central banks had the luxury of cranking up the printing presses to flood the financial system with liquidity, such is not at all likely to be the outcome the next time around, as the market may be left to sort things out on its own. This, of course, would not necessarily be a bad thing, as this is how the market cleansing process can finally play itself out in bringing us to the dawn of the next great secular bull market. But investors that are fully allocated in advance of any such day of reckoning stand the risk of sustaining meaningful losses that may not be so easily recovered the next time around.”

Indeed I would argue that the unusually quick rebound in asset prices since 2009 has been counter-productive in several key ways. First, because it has served to quickly re-establish present conditions among the top three most over-valued and dangerous environments for capital since 1929 and 2000. Second, because it has bred extreme moral hazard and over-confidence among participants, reminiscent of the ‘near-miss’ psychological phenomenon described by Malcolm Gladwell where those who were nearly wiped out in the financial crisis, but then revived on central bank bailouts, have now become less fearless and more brazen in their risk-taking. Stay-tuned, this story is not yet finished…