“Artificially depressed interest rates punish savers and cause them to seek yield by channeling funds to more and more speculative areas of the economy, while encouraging already indebted borrowers to take on more debt so long as the debt can be serviced for now.” John Hussman, Broken Links, Aug 25 2014

Individual families have borrowed themselves into financial demise the past few years. The evidence of stress and financial fragility is everywhere we look. See: Canadians are indebted and stressed about it, for the latest staggering statistics.

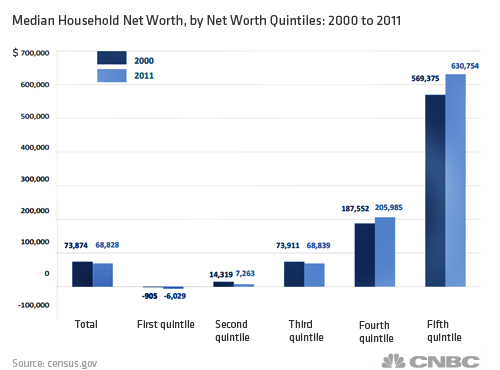

Americans are a little less indebted than Canadians today thanks to some US debt write downs and foreclosures over the past couple of years, but the latest report shows that the median net worth for Americans as a whole declined by 6.8 percent between 2000 and 2011. See: Wealth gap widened.

Trillions of reckless monetary injections by misguided central banks have purchased negative net worth gains for the bottom 60% of American households (between 2000 and 2011), and just a 10% increase (less than 1% gain per year) for the top 20% of the population, as shown in this chart.

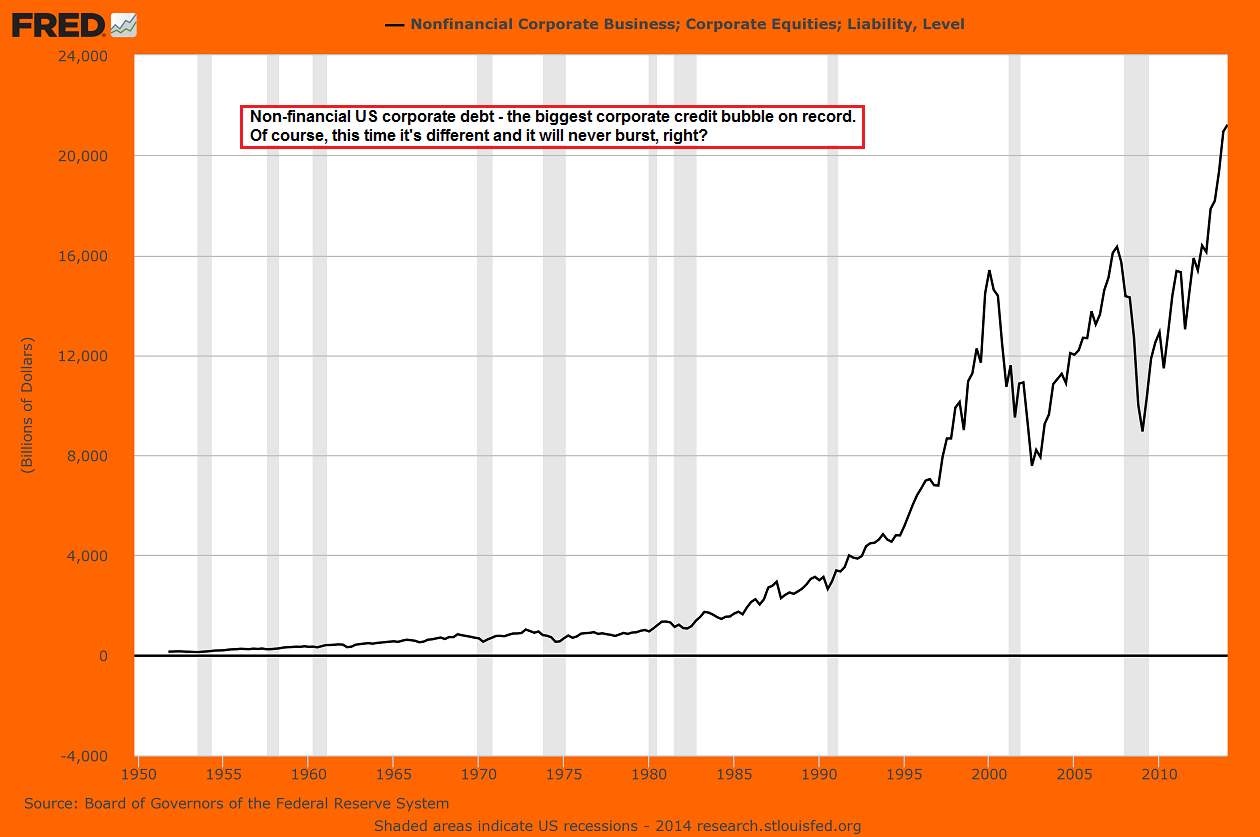

Meanwhile corporations have borrowed themselves into a perilous future as well. With poor demand and weak growth prospects, companies have also been enticed to borrow unprecedented levels at low rates in order to buy back their own shares (buying high) to boast short-term earnings and corporate bonuses at the expense of financial stability and longer-term health. Here’s where corporate debt sits now.

Meanwhile corporations have borrowed themselves into a perilous future as well. With poor demand and weak growth prospects, companies have also been enticed to borrow unprecedented levels at low rates in order to buy back their own shares (buying high) to boast short-term earnings and corporate bonuses at the expense of financial stability and longer-term health. Here’s where corporate debt sits now.

So borrowers have gone postal. But so too have those with savings to lose as they have increasingly tossed it into the highest risk bonds and stocks in a desperate push for yield even while sacrificing the capital itself. With every asset now over-bought and over-valued, only the junkiest, junk is yielding more than 4% as shown here. And the risk-reward tradeoff is completely unattractive.

This is now officially the largest credit bubble the world has ever known. Borrowers never do repay that which they cannot. There is no chance the debt can all be repaid, many zeros will be crossed off balance sheets before this mess is resolved. This means that indiscriminate lenders will be the biggest losers here. Which brings me to this lucid quote from Charles Gave this month:

“The big central banks seem to believe that printing money creates wealth. What such policies, in fact, do is ensure a different distribution of wealth that increases leverage and favors not legitimate risk takers, but groups which are politically well connected such as the too-big-to-fail banks. As such, the current approach is a clear expression of a policy captured by a crony class, and needless to say it is defended by the same group. This is not to engage in conspiracy, or to claim malfeasance by particular individuals. But what cannot be doubted is that even as those closest to the money source have made out like Cantillon, the outcome for pretty much everyone else has been awful. Looking forward, this cannot go on and I would hence avoid financials everywhere.”

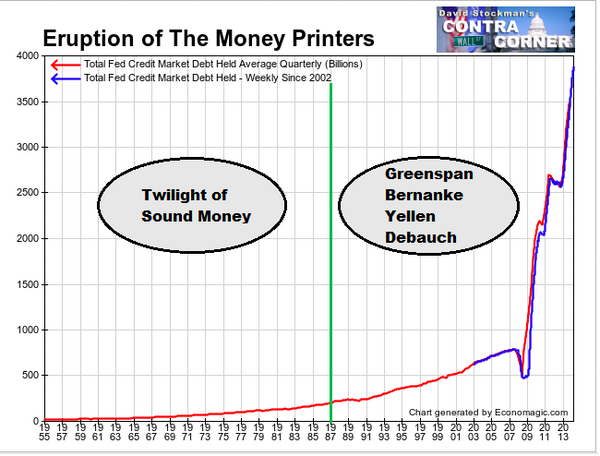

And with Federal Reserve debt that looks like this next chart below, there is no one to bail out the banks this time. A crazy cycle in history is thankfully headed to a much needed end/cleanse.

It has been said that suicide is a permanent solution to a temporary problem. It is financial suicide to pile cash into assets at irrationally high prices in order to appear like one is making short-term gains. Better to wait for prices worth taking once more. They will come for those who are ready.