Word to central planners everywhere: the path to sustainable economic growth is not ‘get rich quick schemes’, more debt and monetary tricks. The solution is found in equitable societies governed by the rule of law, equal opportunity and strong households buoyed by wage growth, falling debt and strong saving rates who then feel optimistic and healthy enough to have children.

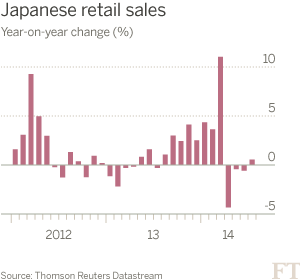

“Despite ebullient forecasts that seemed to shrug off the effect of Japan’s sales tax rise, July’s economic figures from Tokyo have showed that the Japanese economy is continuing to struggle.”Most analysts expected a strong rebound in retail sales and household spending as stockpiles collected before the tax hike should have run out, but no such reality emerged. Instead, retails sales fell 0.5%, and household spending dropped 0.2%. Reevaluation of the data now shows that Japan is in an odd conundrum—inflation is both too high and too low. It is too high because the tax hike have had a legitimate curbing effect on household buying power, and too low, because at 1.3%, real inflation is still too weak to convincingly keep Japan out of a deflationary cycle. Wages have not risen along with this real and “imposed” inflation, so the bulk of Japanese are much worse off than when Abenomics started in April 2013. Part of the issue is that Japanese exports have not risen alongside the weakening of the Yen.

After 15 months, Japan seems essentially no better off than before its major stimulus. It is anyone’s guess how the dynamic duo of Abe and Kuroda will handle this situation.”

See: Abenomics: Japan Flounders and Japanese Economy Flounders after sales tax rise.