About 9,000 U.S. taxpayers have each accumulated at least $5 million in individual retirement accounts, said the Government Accountability Office, raising questions about some investors’ tax-advantaged returns. Here is a direct video link.

Meanwhile CNBC reports on the drop in 401(k) balances among the majority of households nearing retirement. Here is a direct video link.

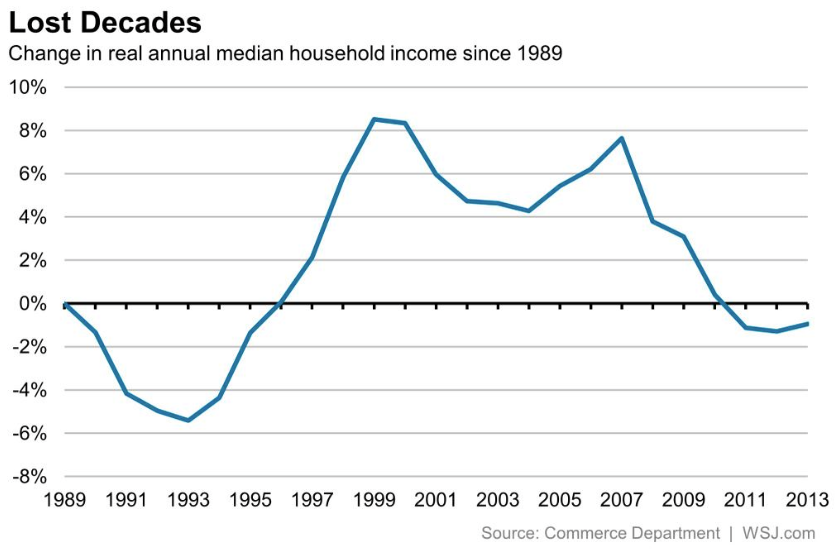

Yes some people work harder than others. Yes some people save more than others. But the real reason for the massive polarization between the top .1% today and everyone else has most to do with the level and type of income each is able to earn. As shown below, most workers are paid in wages which have been falling since 1999 when Central Banks and governments decided to promote the financial-ization of the global economy and asset bubbles as a primary monetary tool. Companies have responded to slowing revenues by slashing payroll costs in order to increase their earnings per share.

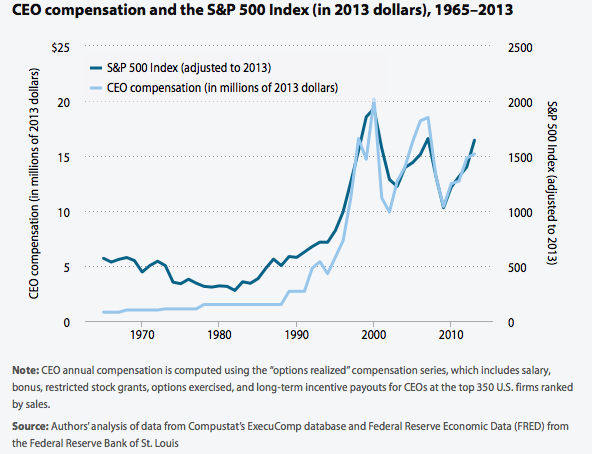

At the same time executive compensation has increasingly focused on stock options that have ballooned and crashed and ballooned with the S&P 500 over the past 18 years as shown below. As the c-suite has become obsessively focused on their own share price to increase their compensation they have funneled corporate cash away from capital expenditures and investment in their business and into share buy backs as a sure fire way to goose their own pay. As a result, executive pay that was 20 times the average worker in 1965, is today nearly 300 times the average worker.

At the same time executive compensation has increasingly focused on stock options that have ballooned and crashed and ballooned with the S&P 500 over the past 18 years as shown below. As the c-suite has become obsessively focused on their own share price to increase their compensation they have funneled corporate cash away from capital expenditures and investment in their business and into share buy backs as a sure fire way to goose their own pay. As a result, executive pay that was 20 times the average worker in 1965, is today nearly 300 times the average worker.

It may all sound like good fun, but it is actually self-defeating: it has made the entire economy weaker and vulnerable on the violent swings of a boom and bust crash course. (Read: Robert Frank’s “The High Beta Rich”, for more on why that’s a problem for tax collection and budget planning).

It may all sound like good fun, but it is actually self-defeating: it has made the entire economy weaker and vulnerable on the violent swings of a boom and bust crash course. (Read: Robert Frank’s “The High Beta Rich”, for more on why that’s a problem for tax collection and budget planning).

When this present asset bubble bursts again, we will see once more how incredibly wasteful and misguided capital allocations have been the past few years. And the entire society (.1% and everyone else) will realize that we have fallen far behind in productive investment and policies needed to enable a progressive and sustainable economy.