First we had the OECD warn on Monday that current market bullishness appeared “at odds” with the “intensification of several significant risks.”

This morning we have the International Monetary fund, the world’s watchdog for financial and economic stability, warning that the global economy faces a growing risk from highly levered financial market bets that could “abruptly” unravel on geopolitical disruptions or a shift in U.S. interest rate policy. (So a shift like the +450% increase in policy rates that the US Fed sees themselves making in the next 12 months?) See: IMF warns: investors are taking excessive risk in the markets

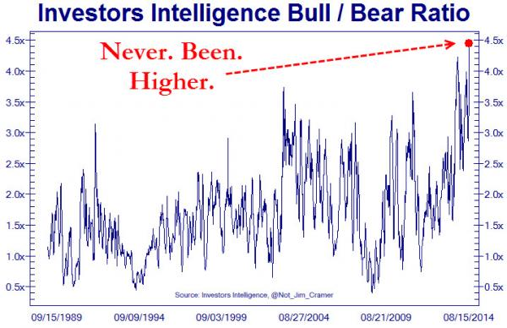

And yet, the number of financial ‘experts’ voicing concerns has never been lower. As shown below, there are far more bulls today than at the suicidal market peaks of 2007 or 2000. (For important perspective, note below how few bulls there were at the cyclical market bottoms in 2002 and 2009 when investment opportunities were the most attractive in decades).

The internet and multinational financial and media conglomerates have made for unprecedented global consensus building behind misguided beliefs around central bank powers and economic strategies today. The heads of all the major central banks and financial conglomerates went to the same schools and worked at the same sell side firms before moving into present positions of influence and leadership. Not surprisingly then, they have recommended and implemented the same disastrous policies and ideas all over the planet. This has made the scope and scale of the present financial bubble and coming bust, the largest and most devastating the world has ever faced to date. At the same time, for individuals who are in their later working years or retirement, the room for error has never been lower and the capital too lose never higher.