Drug resistance is the name for a reduction in drug effectiveness over time. Perpetual “add debt and stir” monetary prescriptions are no different. Years of over-use have now rendered more debt highly ineffective at treating reduced consumption.

As pointed out by Grant Williams recently, where in the early 1950’s a dollar of increased debt in America multiplied to nearly $5.00 of increased demand in the overall economy, between 2001 and 2012 this effect diminished to some $0.08 of increased GDP for each new dollar of debt. In other words, increased debt financing has been an inefficient capital trade-off– detracting from future spending–for years. That future is now here.

Some of this is that an aging population wants less consumer goods. But the balance is due to the paralyzing effects that low savings and ongoing debt payments have after years at zero bound rates and every crazy financing scheme imagined to entice borrowing far beyond healthy limits.

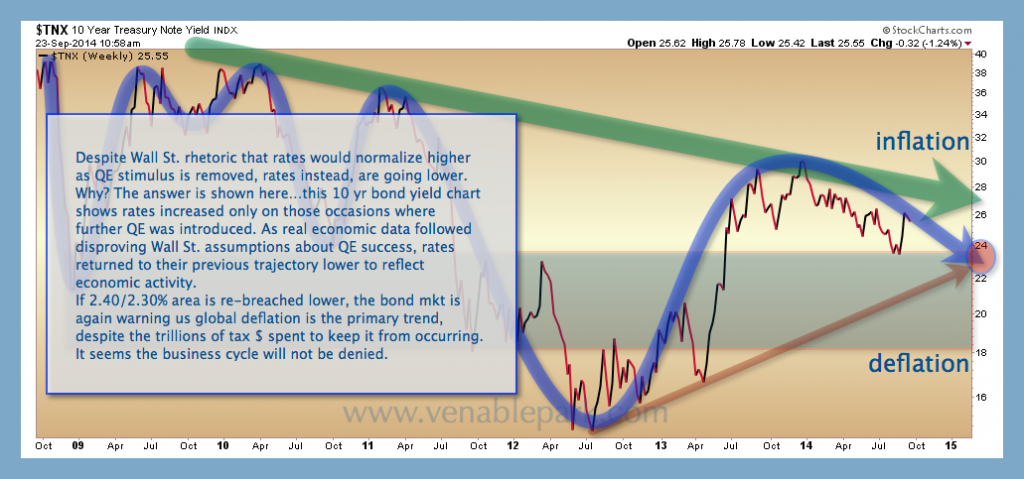

The foreseeable endgame is taking many by surprise and throwing traditional economic theory on its stubborn and foolish head as shown in the chart below See: Let there be bubbles for some more excellent context.

Aging demographics and debt resistance are the main reasons that central banks have lost their once significant force on the global demand throttle. This updated chart of the US 10 year Treasury yield speaks volumes: 6 years of massive global stimulus and interest rates continue to signal more deflation ahead.

Aging demographics and debt resistance are the main reasons that central banks have lost their once significant force on the global demand throttle. This updated chart of the US 10 year Treasury yield speaks volumes: 6 years of massive global stimulus and interest rates continue to signal more deflation ahead.