Speaking in a 2013 interview, “No One Would Listen” Author and Madoff whistleblower, Harry Markopolos explained that looking at fund performance, he could immediately tell that Madoff was running a Ponzi-like scam and not a savvy strategy as most believed:

“Bernie’s returns were going up at a 45 degree angle in a straight line and we don’t have straight lines in finance; and in options everything is a curve—there is nothing straight in an option. So, I knew it had to be fraudulent right off the bat in the first five minutes.”

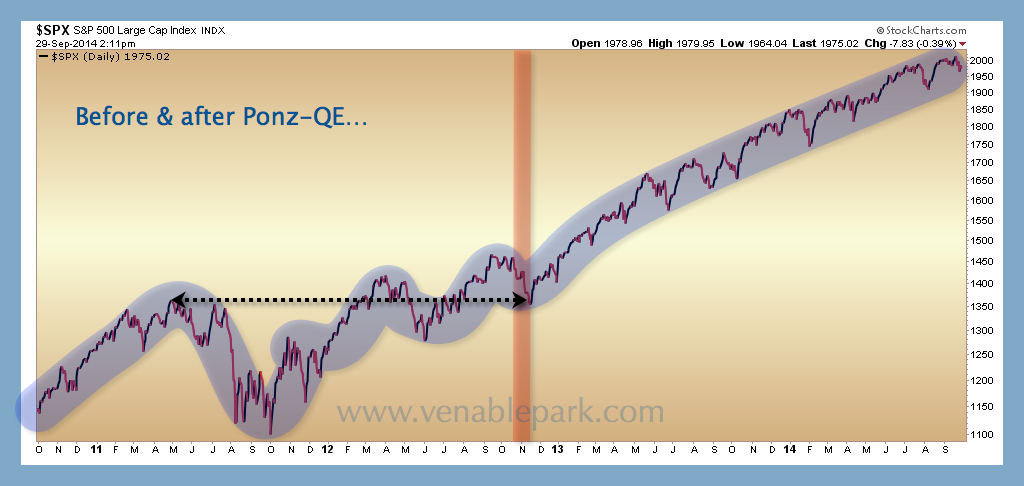

As we consider this quote, behold the S&P 500’s straight line advance over the past 24 months since Q’Ever was announced by the US Fed. In the process, the low volume ramp has attracted more bullish believers than at any time since just before the crash of 1987. And the conventional ‘wisdom’ in the financial business remains: buy more, buy always, never sell.