Canadians have traditionally been known for being nice and producing comedians. There was also a time when our households were known as being more fiscally conservative than our US cousins: in 1980 Canadian household savings rates were more than 17% of disposable income compared with 10% in America.

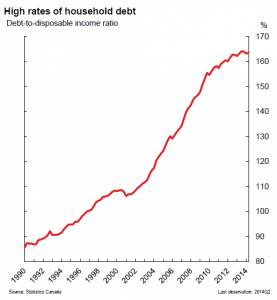

Unfortunately that all changed over the past 15 years as interest rates fell. Canadians, like other countries, were seduced to the dark side: debt-abuse. Today Canadian household debt has reached a record 164% of disposable income and higher than the US’s 2006 debt cycle peak.

When the global credit bubble burst in 2008, Canada didn’t get the memo. Rather than enter fiscal rehab, as shown in the chart beside, Canadian families threw themselves under the credit bus even further.

When the global credit bubble burst in 2008, Canada didn’t get the memo. Rather than enter fiscal rehab, as shown in the chart beside, Canadian families threw themselves under the credit bus even further.

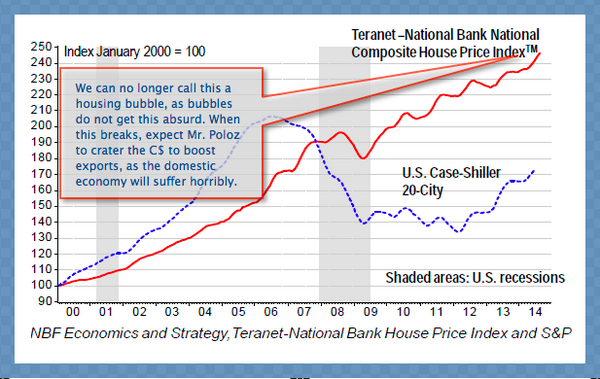

Today, the true north strong and free has the distinction of being home to the top handful of realty/credit bubbles in modern history. This chart below comparing the Canadian National Home Price Index (red) since 2000 with the US Case-Shiller home price index (blue), gives a sense of the likely downside for Canada’s now painfully levered home prices. See: The Monumental Housing Bubble up North: Canada’s implosion may be the next, for more.

And it doesn’t take higher interest rates to start the mean reversion process. Even at continued low rates, debt-service exhaustion is enough to slow household spending. And that’s before a rising US dollar continues to clobber commodity prices; before slowing global demand cuts exports and jobs.

And it doesn’t take higher interest rates to start the mean reversion process. Even at continued low rates, debt-service exhaustion is enough to slow household spending. And that’s before a rising US dollar continues to clobber commodity prices; before slowing global demand cuts exports and jobs.

To further compound coming losses, the Canadian stock market recently retouched its 2008-commodity bubble high and rolled over. Having lost heavily in 2000-2003, 2008 and 2011, over the past year, Canadians have been increasing their holdings in equities. At the same time, there is also evidence that the investment sales force has been again marketing its capital- devastating “Smith maneuver”, where individuals borrow against their homes to buy equities. When home and stock prices fall, the debt levels remain and these ‘strategies’ are likely to be life-altering in all the bad ways.

Financial penance will be paid once more. This time the population is that much older and has much less time to rebuild.