One is reminded of all the people who wrote and spoke so passionately about why gold and silver could only go higher…another sad example of buying a story without understanding the capital cycles driving it.

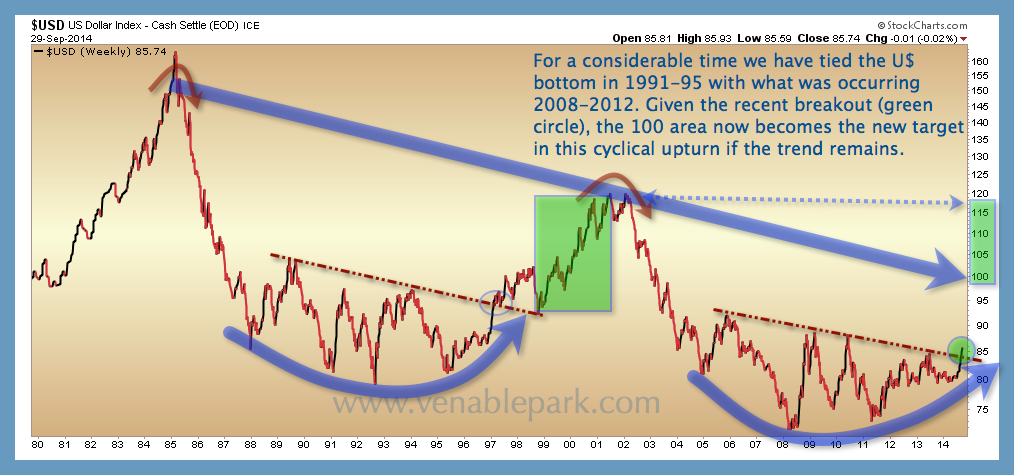

Today the headline ‘strong US jobs report’ gives the Fed further justification to continue on their desired and politically necessary retreat from ‘Quantitative Easing’. This is supportive for the dollar. Now through the 86 resistance line (far right below), the 100 level is the next test area ahead.

A rebounding dollar will continue to translate US multinational earnings lower (the reverse of what helped push S&P 500 earnings well above historic norms as the dollar fell). It will also hamper US exports and intensify deflationary effects in other export-focused economies who are all battling each other to make their goods cheap for foreign consumers. It is also likely to continue driving metal prices lower for a while longer: gold is -9% over the past year, and -38% from the 2011 peak, silver is -24% over the past year and -65% since 2011.

As the long term chart of gold shows below, now hovering just above previous support at 1180, a failure to hold this level suggests a retest into the 700 to 1000 orange band last tested in the 2006- 2008 liquidity crisis.