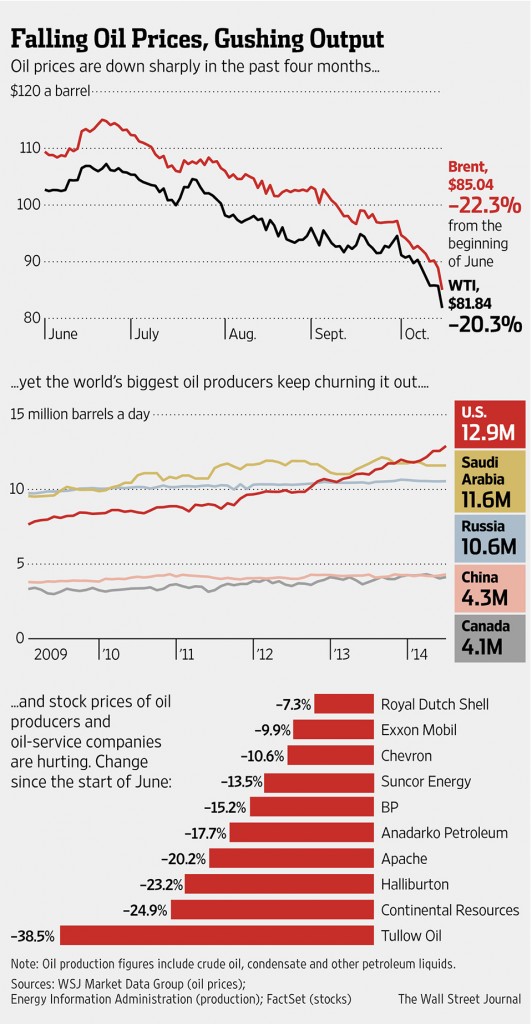

West Texas Crude is today flirting with $80 a barrel, down 10% year to date, 24% since the QE-rebound into 2011 and 45% since the bubble mania of 2008. Oil cos are taking a much deserved drubbing in the process (chart to left).

Global oil supply continues to overwhelm demand as technology advancements have bumped US production to levels not seen since the 1980’s. Here’s a stat: since 2004, U.S. oil production increased 56% while U.S. demand for gas and other fuels fell 8%. See: Global oil glut sends prices plunging.

Global oil supply continues to overwhelm demand as technology advancements have bumped US production to levels not seen since the 1980’s. Here’s a stat: since 2004, U.S. oil production increased 56% while U.S. demand for gas and other fuels fell 8%. See: Global oil glut sends prices plunging.

The host of new tech-savvy competitors, brings increased competition to pricing that was previously ‘controlled’ by the OPEC cartel (mainly the Saudis).

Break-even pricing for many US shale producers is said to be in the $80 to $85 a barrel range, so at present prices, projects are quickly becoming uneconomic. In the bigger picture it also presents fiscal problems for many exporters whose budgets have been based on higher prices to sustain their expenditures.

In previous recessions, as prices fell, the Saudis announced production cuts to help support pricing. This time there is talk of their plan to maintain production in the hopes that falling prices will serve to wipe out some of the more recent global competitors and restore OPEC power in the longer run. As the chart below shows, a decline below $80 for WTIC, would be a breach of the secular up trend that has held since 1999. If the secular trend is broken, a decline to long-term support in the $40 a barrel range would be within the realm of technical probabilities.

On the fundamental side, we think that falling demand as the global economy again recesses, along with excess inventory and the proliferation of alternatives and more efficient energy usage, are all reasons for the secular bull that began for oil in 1999 to now end.

On the upside, the next economic ‘recovery’ is likely to be less about monetary tricks out of central banks and more about consumers finally rebuilding their personal balance sheets through increased savings and lower spending. Lower energy prices will help households cut expenses as they continue to pay down debt.