The head of the Bank of International Settlement’s market committee, Guy Debelle, warned in a speech in Sydney this week that “global markets are dangerously stretched and may unwind with shock force as liquidity dries up.” In addition, Debelle added that investors have become far too complacent, “wrongly believing that central banks can protect them, while making shaky bets that are bound to blow up at the first sign of stress.”

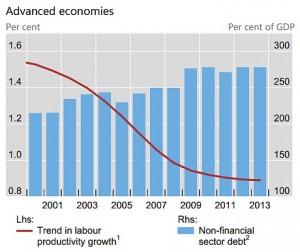

Worse than the 2008 crisis, Debelle pointed out that the world has never been more leveraged than it is today with debt ratios far higher today than the peak of the last crisis. While advanced economy debt levels peaked at 250% of GDP in 2007, since then they have risen to more than 275% as shown in this chart.

At the same time, interest rates are already at zero across most of the industrial world: “that is a point we haven’t started from before” when heading into a global downturn, Debelle pointed out. This means monetary tools that have historically been used to help truncate downturns are not available this time. See: BIS warns on ‘violent’ reversal for global markets

Make no mistake: the next bear market is no black swan. It has been well earned, and participants have been amply warned.