With the equity mongrel horde still calling for higher interest rates and insisting that bonds are for dummies– even though the total return on treasuries has outperformed the total return on stocks by 5.7 x since 1982 (well how’s a devoted risk-seller to make outrageous commissions if people insist on owning the lowest risk deposits for heaven sake?)– here’s a thought: what if US government bond prices were only just started into their next leg of ascent?

I have written many times about higher yielding North American treasuries being relatively attractive when compared with other developed country bonds and in an era of strong deflationary forces caused by a global debt overhang and aging demographics. See: North American Treasury yields: how low can they go? for more context.

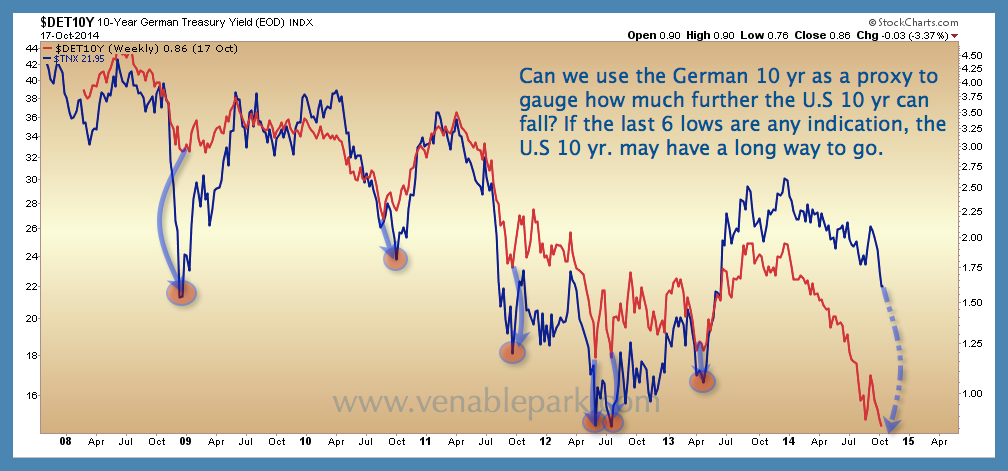

As shown in the chart below, each time the German 10-year yield has taken another leg lower during the economic ‘recovery’ over the past 6 years, the US 10-year has not only followed, but actually made a lower low (ie., US treasuries have increased in price by more). With the German 10-year yield today at .84%, the US 10-year yield is now looking downright fat at 2.19%. Could this time be different? Or could US 10-year yields actually move below 1% in risk-averse months ahead (as per dashed blue line) and racking up further capital gains in the process? The answer seems to be yes. Of course, don’t look for the investment sales monkeys to see that one coming…