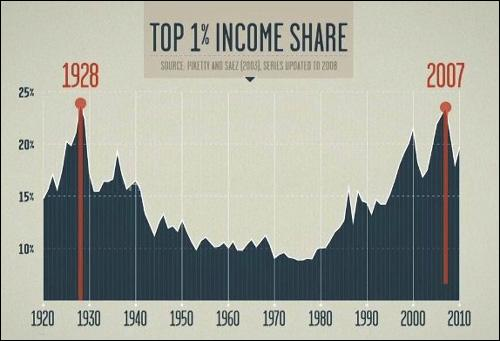

The present spike of wealth (asset values) above income coincides with similar tops in 1929, 2000 and 2007. Here is a direct video link.

This chart from the Inequality for all, documentary, also shows peaks in the top 1% of the population’s income since 1920. We can see that while the financial/leverage bubbles of 1928, 2000 and 2007 inflated incomes for the 1% holding financial assets (because total income includes stock options, capital gains and dividends) historically the effect has always been fleeting, dramatically mean reverting once asset values collapse once more. The declines also then crush government tax revenues that during the bubbles become concentrated on capital gains and inflated property values rather than employment and business income. This causes sudden and dramatic deficits for municipal to Federal budgets in the process.