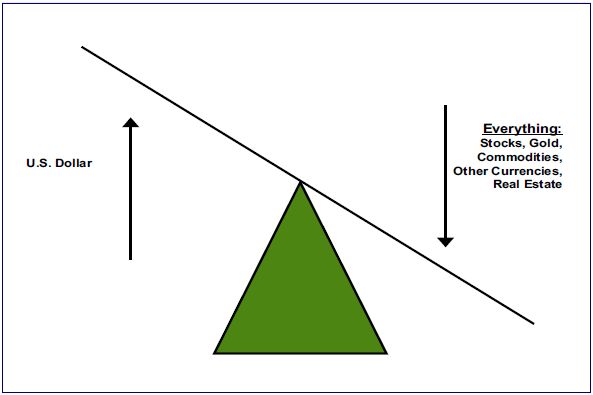

As commodities rallied 2002 to 2008, most people were oblivious to the huge role that a falling US dollar was having in inflating the price of other assets. We referenced the following teeter totter chart many times in our presentations.

Since 2011 as the US dollar has strengthened, the inverse relationship has held to the surprise of most. The ride may have just begun….

Since 2011 as the US dollar has strengthened, the inverse relationship has held to the surprise of most. The ride may have just begun….

“Crude oil prices face several factors that could send it below current levels, notably the quickly strengthening U.S. dollar, Raoul Pal of Global Macro Investor said Tuesday.

“The probability of a dollar breakout is very big. So, if that happens, then the chances of the dollar moving much more rapidly than we’ve seen for many, many years, and that would lead oil to go much further,” he said. “So, prices in oil could go down to $30, $40 easily if the dollar moves in the way that I’m thinking it possibly will.”

Here is a direct video link.