I recall being on an ‘experts’ panel at a resource investing conference in Calgary in 2011 when commodity prices had sharply rebounded out of the 2008 collapse and the question was asked, “do you think the ‘great commodity bull’ market has ended?” I was the only person on the panel who answered yes. Since then as I have continued to write and speak on this topic, I received a regular flow of correspondence from commodity bulls who insisted I was everything from wrong to a fool, and demanded I , “stop saying such ridiculous things.”

None of this is rocket science. Commodity booms are an investment cycle that begin out of scarcity and end amid an embarrassment of supply. This particular run was greatly magnified by the credit bubble from 2001 to 2008 and then QE-financed speculation between 2009 and 2013. Credit magnification works both ways, and so the mean reversion now in process is likely to be equal and opposite as prices deflate. Rapid declines serve to implode levered players. And since most market participants are not proactive, independent thinkers, but rather herd following masochists, losses that are highly predictable are always “unexpected”.

We now seem to be in the early stages of the belief phase, where a growing consensus begins to recognize just how dumb past narratives have been. See a summary on oil moves here: Oil at $40 possible? The answer, as shown below, seems to be yes.

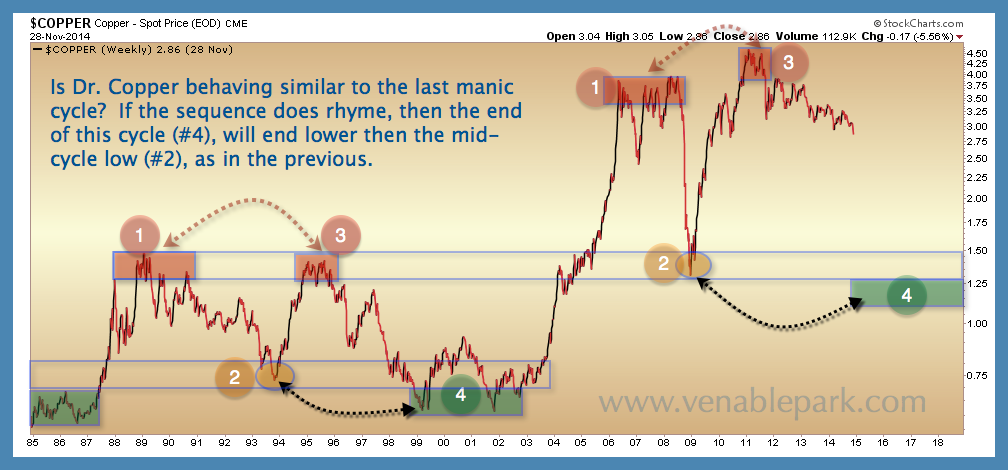

At the same time, Copper, perhaps the commodity most over-produced, stockpiled and price-rigged by financial intermediaries the past few years (see How JP Morgan struck gold with copper), has finally broken down beneath the $3.00/lb level it had mysteriously hovered above since the 2009 rebound.

At the same time, Copper, perhaps the commodity most over-produced, stockpiled and price-rigged by financial intermediaries the past few years (see How JP Morgan struck gold with copper), has finally broken down beneath the $3.00/lb level it had mysteriously hovered above since the 2009 rebound.

In 2007-09, pretty much every commodity and stock market plunged 30 to 70% before bouncing off long-term support into a breathtaking “V” rebound on the belief that government injected liquidity could offset the weakness of a secular decline in consumer demand. But that was 2009 and this is now. Now is a time with more debt, and an even older population, in most countries. If we are to truly to correct from the excesses of the credit bubble, then previous cycle lows in 2009 are unlikely to prove sufficient this time. In addition, once it begins, the next cyclical rebound is likely to be considerably slower than the last, as participants shift from an era of reckless gaming to one of sober investment. Here is a big picture view of the copper spot price since 1985.

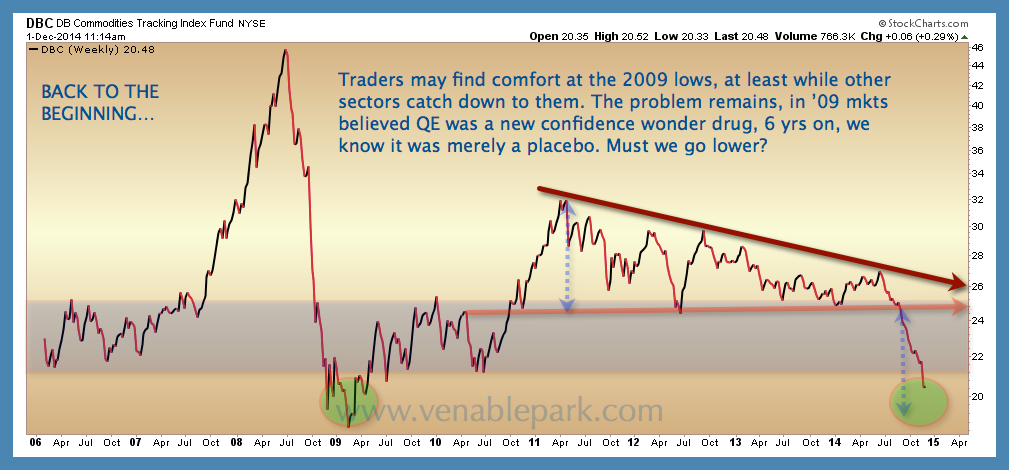

And of the Commodities Index (DBC) since 2006.

And of the Commodities Index (DBC) since 2006.

With the largest share of global capex and R&D spending coming out of the commodity sector since 2006, crashing profits there will spread further weakness across the broad economy (particularly investment banks) as investment and dividend programs are now necessarily scaled back.

With the largest share of global capex and R&D spending coming out of the commodity sector since 2006, crashing profits there will spread further weakness across the broad economy (particularly investment banks) as investment and dividend programs are now necessarily scaled back.