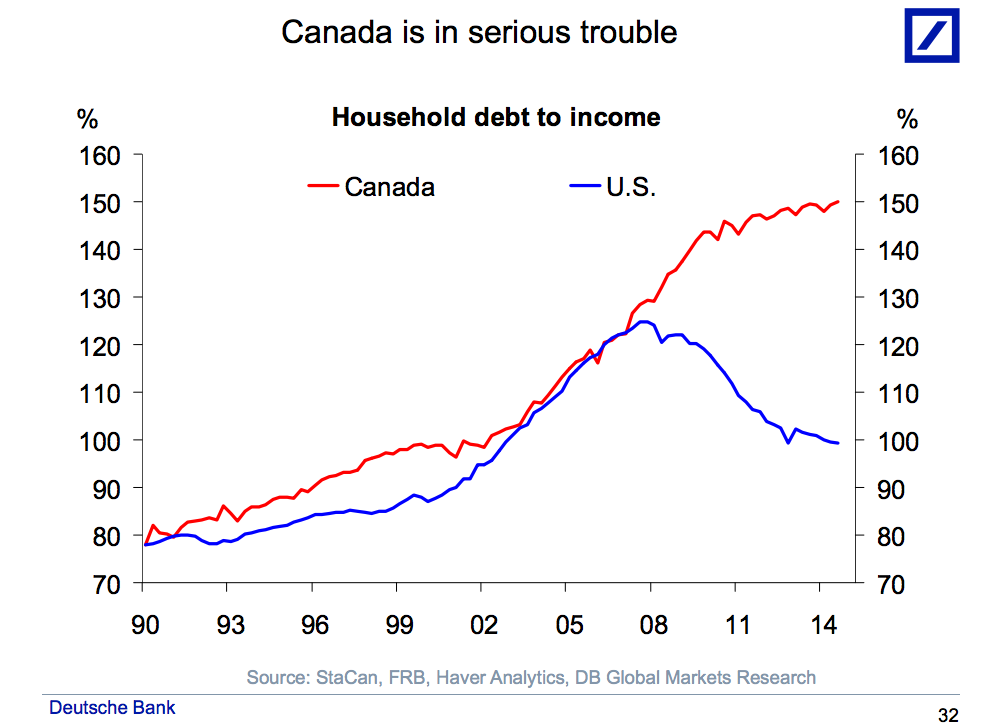

It doesn’t take genius or clairvoyance to figure out that Canada and its banks are coming into a period of deep, debt regret… See: DEUTSCHE BANK: ‘Canada Is In Serious Trouble’

Simply put, debt levels are very high, and with sky-high home prices cooling off, we could see pressure on the Canadian financial system and labor markets. While US households have been deleveraging since the Great Recession, Canadian household debt as a percent of household income is higher than ever.

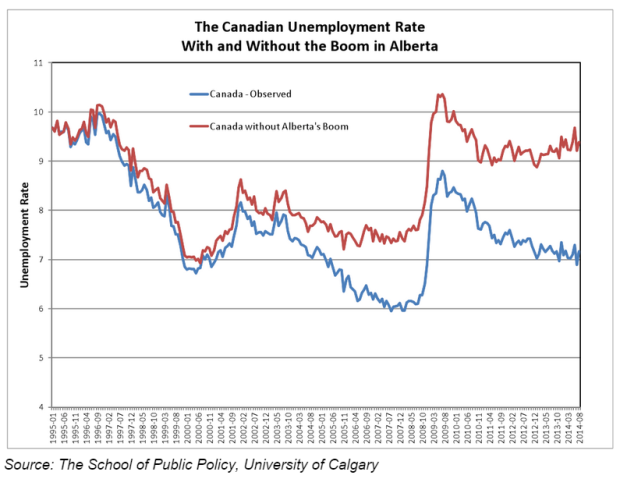

These debt levels paint the very portrait of financial fragility as Canada is now side-swiped by crashing oil revenues and the falling tax receipts and rising unemployment this brings. After all, as seen below, the oil boom produced the lion share of new jobs in Canada since 2008. As layoffs mount in the sector now, national unemployment numbers will rise.

These debt levels paint the very portrait of financial fragility as Canada is now side-swiped by crashing oil revenues and the falling tax receipts and rising unemployment this brings. After all, as seen below, the oil boom produced the lion share of new jobs in Canada since 2008. As layoffs mount in the sector now, national unemployment numbers will rise.

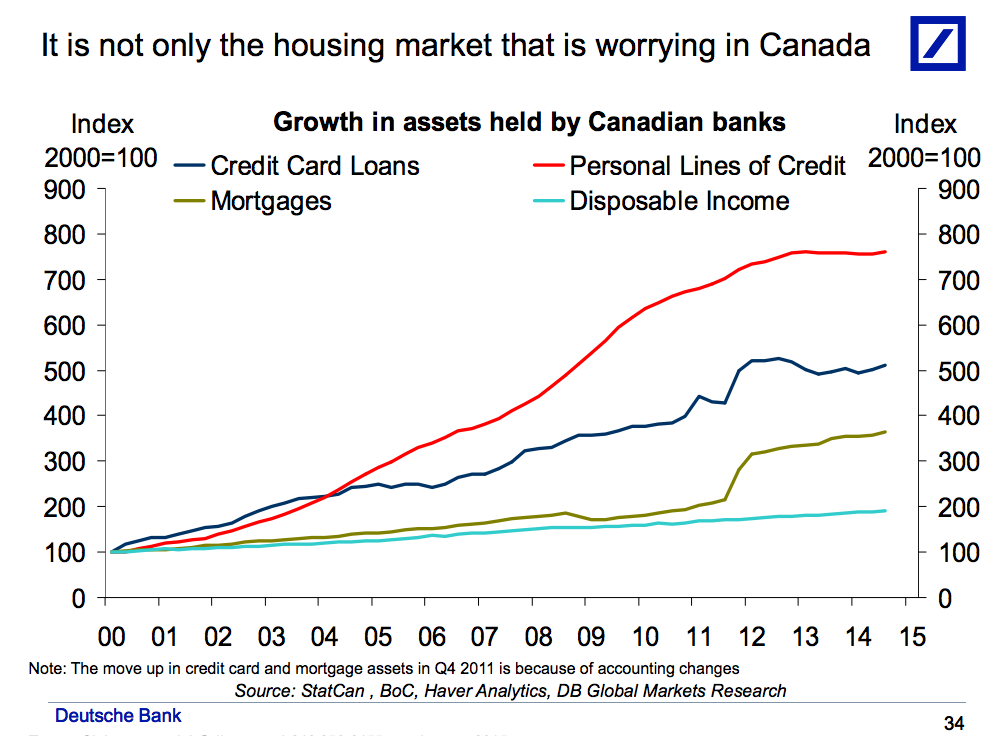

And then there is the concentration risk held in Canadian banks today. Not only are they holding silly levels of subprime debt from wobbling energy companies, but they have extended record levels of household debt as well. In the process, disposable income (bottom line in blue) has flat-lined even with modest wage gains and the lowest interest rates in modern history.