Financial sector shares have historically traded in cyclical correlation with real economy sectors like minerals, mining and materials in North America. After all financial fees are not a driver of the real economy, but rather a tax that rides with it. This chart shows financials in blue (XFN) and the Canadian Resource Sector Index (lower purple) since 2003. In a remarkable divergence the past 2 years, QE and other gifts to banks have allowed financial shares to trade in a world of their own fixing, which has opened a remarkable crocodile jaw gap between the two indices shown below.

But no one gets it all their way forever, and recently disappointing earnings and negative shocks to the world economy have been knocking financial shares off their ‘permanently high plateau’ once more. As shown above, having recently broken their late 2012 QE-ever uptrend (see green line at top), the weight of the world is pushing on the financial sector to recouple with other leading sectors toward the 2009 bear market lows. A closer look at the weakness in the financial index (blue line) can be seen below.

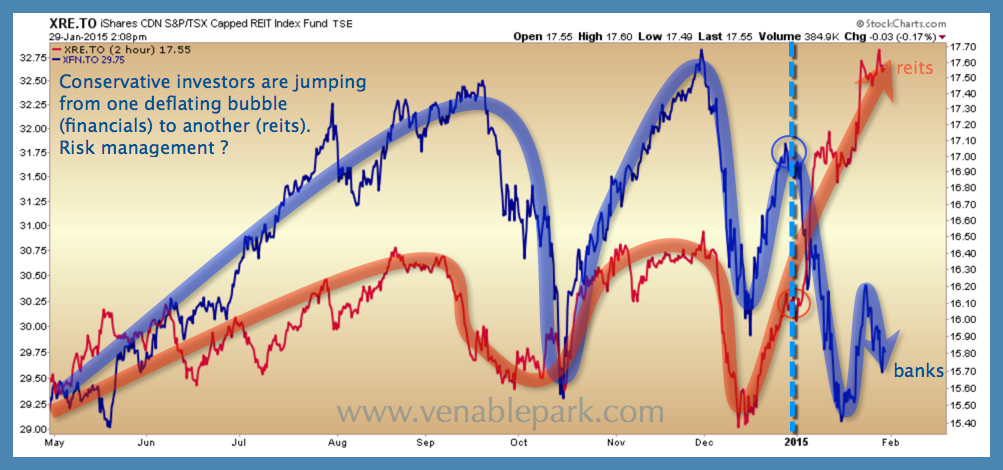

Unfortunately as retail investors churn round and round the risk bush, nervous capital has been pulling out of sinking banks (XFN down 9% so far) and moving into deliriously priced REITs (XRE index in red) hoping for a smoother ride. What they are more likely to find however, is another train wreck in motion.