The financial fabric of the world is in tatters. That much is clear. An appearance of liquidity to date, has been simulated through a toxic web of debt, debt derivatives, and misplaced confidence in central bank powers. This weekend a terrified and tortured Greece faces the end of its credit lines once more. And it seems that in the past few days, the Germans (who with France, are the largest holders of Greek bonds) may be softening their previous ‘no restructuring’ stance. After all the Germans have the most to lose financially if Greek bonds default and weak countries like it begin to exit the shared currency.

A rocket higher to a more Deutschmark-concentrated Euro would be a sharp adjustment for what has been the highly lucrative German export machine since its adoption of the common currency in 2002. But even if the Greeks do get to an emergency bridge loan (from the EU, or other potential lenders they have mentioned like China, Russia or America), math will not change: the Greeks cannot pay back what has already been piled onto their tab by lenders to date. As shown here, 89% of all the ‘bail-out’ money advanced to Greece since 2010, actually was paid directly to its lenders in one scheme or another.

What is needed is a debt write-down-off as well as structural reforms within Greece that focus on collecting reasonable levels of tax revenue, downsizing government expenses and getting Greek workers back to self-sustaining employment. That almost certainly means no more extend and pretend schemes and a return to an independent, floating Drachma.

What is needed is a debt write-down-off as well as structural reforms within Greece that focus on collecting reasonable levels of tax revenue, downsizing government expenses and getting Greek workers back to self-sustaining employment. That almost certainly means no more extend and pretend schemes and a return to an independent, floating Drachma.

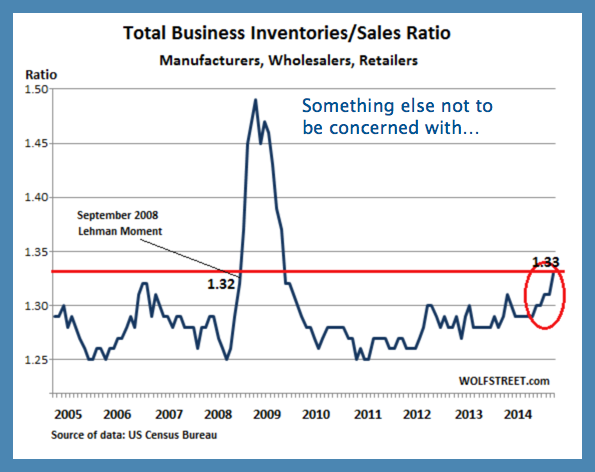

In the meantime, all the focus on band-aid negotiations in Europe and conflict resolution in Russia, are glossing over some larger issues with the global economy and financial markets as we move into 2015. Demand is evaporating week over week, and supplies of pretty much everything are mounting at a remarkable rate. The following chart of the business inventories to sales ratio, captures yet another in a long list of historically relevant indicators suggesting recessionary forces are afoot in America as we write, even as the talking heads prattle on about a US decoupling. Most recently at 1.33, this ratio (as shown below) is now higher than in the opening months of the great financial crisis and bear market of 2008.

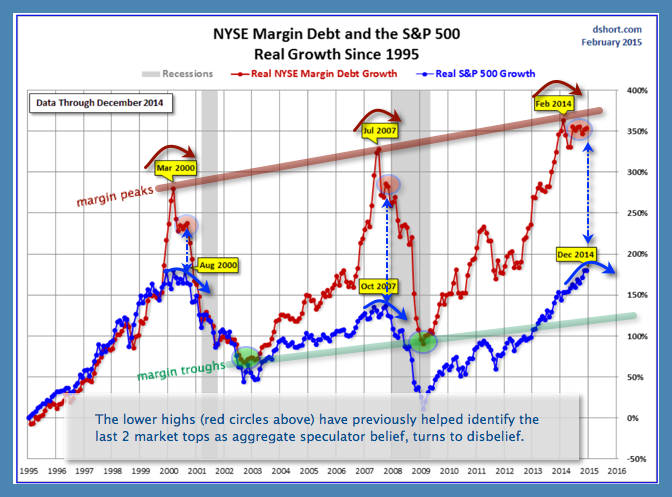

At the same time, as shown below in red, reckless financial speculation on borrowed money (margin), that peaked in February 2014, has since been rolling over in the long overdue, yet inevitable, mean reversion that preceded the stock market collapse of both March 2000, July 2007, and every other speculative frenzy in market history. There is no question the process has been elongated this time compared to other market tops.

At the same time, as shown below in red, reckless financial speculation on borrowed money (margin), that peaked in February 2014, has since been rolling over in the long overdue, yet inevitable, mean reversion that preceded the stock market collapse of both March 2000, July 2007, and every other speculative frenzy in market history. There is no question the process has been elongated this time compared to other market tops.  But as shown in blue at the bottom of the chart, the S&P 500–that has made no real (inflation-adjusted) gains since the tech peak in 2000 (when central bankers of the world went full nut bar promoting debt creation schemes)–is once more set up for (at least) a halving from here. Sooner or later, facts must be faced, and mal-investment punished.

But as shown in blue at the bottom of the chart, the S&P 500–that has made no real (inflation-adjusted) gains since the tech peak in 2000 (when central bankers of the world went full nut bar promoting debt creation schemes)–is once more set up for (at least) a halving from here. Sooner or later, facts must be faced, and mal-investment punished.