Excellent article in the NYT this weekend from Mark Spitznagel, founder and chief investment officer of Universa Investments. Spitznagel is elevated in both intelligence and wisdom– still a very rare combination in finance.

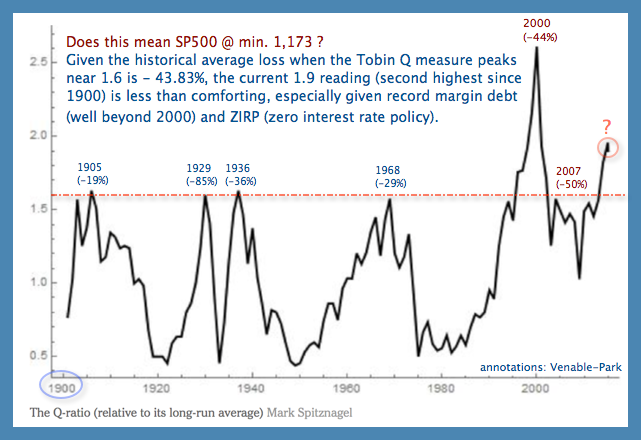

First he offers a chart of the Tobin Q ratio for the S&P 500 since 1900–here with annotation from my partner Cory–(the total aggregate value of publicly traded common shares in relation to the estimated aggregate replacement value of the stock of capital for those corporations (ie., machines, equipment, buildings, chairs, etc.).

As shown on this historically reliable metric (and many others!) stock prices today are the most over-valued in 115 years, but for the fleeting tech wreck top in 2000:

As shown on this historically reliable metric (and many others!) stock prices today are the most over-valued in 115 years, but for the fleeting tech wreck top in 2000:

These elevated periods for the Q ratio are clearly unsustainable, because companies cannot borrow and buy back forever. So this highly unnatural mechanism has logical implications not for long-run economic investment and growth (as the Keynesians continue to hope), but instead for short-run stock prices. Complicated statistical analysis is not needed to confirm this.

Each of these high points in the Q ratio — in 1905, 1929, 1936, 1968, 2000 and 2007 — was followed in short order by stock market losses. The peak-to-valley (or the loss from the high price to the low price) subsequent to each high point was 19 percent, 85 percent, 36 percent, 29 percent, 44 percent, and 50 percent, respectively.

…The bear markets we saw following all of these periods were not dreaded “black swan” events at all. They were perfectly predictable, by economic logic alone, the same logic that says governments cannot manipulate market prices without creating distortions that will always, without exception, be counterproductive.

In the next stock market crash, we will be told that the fault was some surprising economic or geopolitical shock. Let’s remind ourselves now that this will be false, the proximate cause rather than the ultimate cause. The ultimate cause is the same ultimate cause that has been demonstrated to us for over a century: distorted and manipulated markets.

These markets are speaking to us yet again. This time around, we need to listen.

For useful historical context on the interventionist policies that have driven repeated periods of equity over-valuation and then collapse, read the whole article here: The myth of Black Swan market events.